UnitedHealth Group Agrees to $69 Million Settlement in 401(k) Lawsuit

UnitedHealth Group has reached a $69 million settlement in a class-action lawsuit over its 401(k) plans, following allegations of providing subpar options to employees. The case, led by Kim Snyder, highlights the importance of fiduciary responsibility and transparency in corporate retirement plans. This landmark settlement could impact over 300,000 employees and set a precedent for how companies manage retirement offerings.

Exploring Dividend-Paying Investment Strategies for Reliable Income

Discover the benefits of dividend-paying strategies for reliable income streams. Learn about high dividend yield and dividend growth funds, and how they can enhance your investment portfolio. Understand the importance of diversification, costs, and tax implications to make informed decisions that align with your financial goals.

Regulatory Raid on Quant Mutual Fund Sparks Investor Concerns

A recent regulatory raid by Sebi on Quant Mutual Fund has raised concerns among investors, impacting fund performance. While some funds like the Quant Small Cap Fund lagged behind their benchmarks, others, such as the Quant ESG Equity Fund, excelled with a return of 9.46%. Despite the challenges, Quant Mutual Fund has seen an increase in assets under management, indicating sustained investor confidence. Stay informed about mutual fund trends and performance metrics to navigate this evolving landscape.

Bill Ackman Aims to Raise $25 Billion for US Closed-End Fund in IPO

Bill Ackman, the prominent hedge fund manager, is set to raise $25 billion for a US closed-end fund through an IPO, leveraging his social media following to attract investors. Despite challenges in the sector, Ackman’s ambitious goal aims to empower Pershing Square to acquire larger stakes in publicly listed companies.

MFG Partners Raises Nearly $300 Million for Inaugural Fund

MFG Partners has successfully raised nearly $300 million for its first-ever fund, Fund I, focusing on U.S.-based manufacturing, distribution, and industrial services in the lower-middle market. With a strategic approach to capital deployment, the fund aims to support growth and value creation in targeted sectors. Investors seeking diversification and growth potential in niche industries can benefit from MFG Partners’ compelling investment strategy and focus on value creation.

Australian Retirement Trust Increases Private Credit Allocations

The Australian Retirement Trust is increasing its private credit allocations to target opportunities in Europe and North America, aiming to raise its position to 2.5 per cent. With a focus on the lower-risk, unlisted segment of the credit market, the firm plans to leverage external managers and internal teams to diversify its portfolio. This move aligns with the growing trend among Australian pension funds, like UniSuper, to enhance private credit investments for long-term success in the current market environment.

International Clean Power Dividend Fund Announces Upcoming Dividend for May 2024

International Clean Power Dividend Fund (TSE:IS) has announced an upcoming dividend of $0.125 per Class A share, managed by Middlefield Group. TipRanks offers valuable insights for investors interested in TSE:IS stock, providing a wide range of resources and tools for informed investment choices.

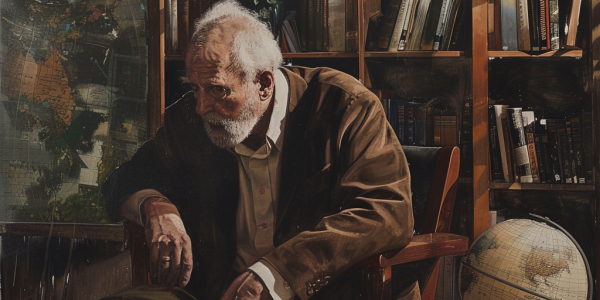

Renowned Mathematician and Philanthropist Jim Simons Passes Away at 86

Renowned mathematician, investor, and philanthropist Jim Simons passed away at the age of 86 in New York City. Known for his groundbreaking work in mathematics and quantitative investing, Jim and his wife Marilyn dedicated billions to philanthropic causes, focusing on research and education in mathematics and science. His legacy lives on through the Simons Foundation, which has made significant contributions to various scientific disciplines globally.

Investing in Israeli Stocks: A Call for Unity and Support

Discover the opportunity to invest in Israeli stocks from outside of Israel and support the nation’s economic resilience in the face of conflict. Despite recent attacks, Israel’s economic indicators remain strong, with major companies like Intel making significant investments in the country. Learn how investing in Israeli businesses can help defend and support the nation’s innovation and commerce.

Hedge Fund Manager Dan Niles Picks Nvidia, Meta, Microsoft, and Amazon as Top Stock Picks for 2024

Hedge fund manager Dan Niles predicts Nvidia, Meta, Microsoft, and Amazon as top stock picks for 2024, citing their earnings potential and analyst forecast increases. Niles believes the rise of these stocks is not a bubble and points to Meta’s investment in Nvidia’s AI chips as a key factor. Nvidia’s stock popularity among retail investors has also surged, surpassing Tesla’s.