CFPB Takes Action Against Performance SLC and Performance Settlement for Deceptive Practices

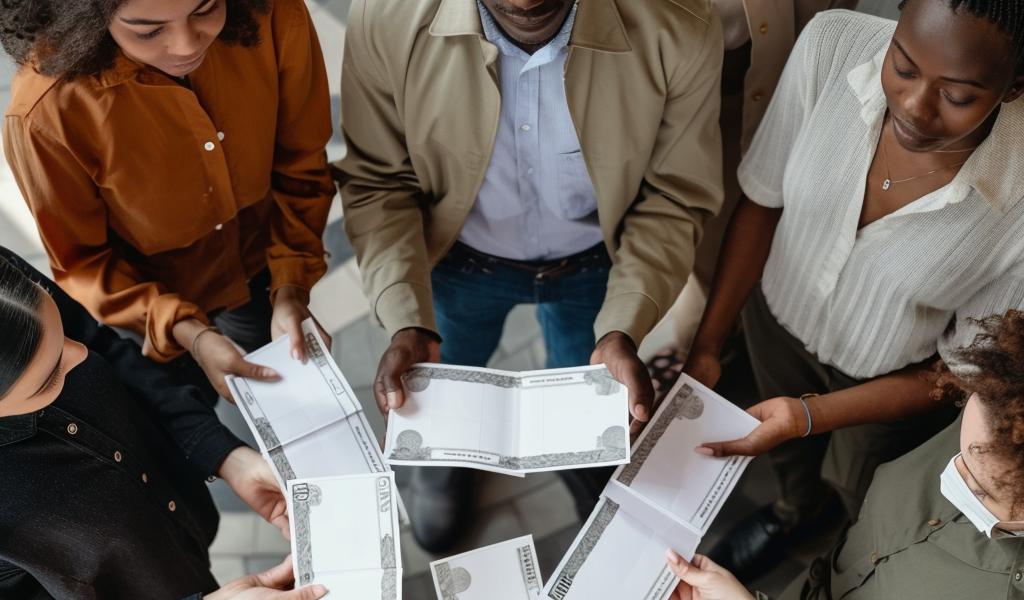

This month, over 8,500 consumers who were affected by Performance SLC, a student loan debt relief business, and Performance Settlement, a general debt settlement company, will receive compensation totaling more than $10.9 million. The Consumer Financial Protection Bureau (CFPB) has taken action against these companies for their deceptive and illegal practices.

Performance SLC charged thousands of consumers with federal student loans approximately $9.2 million in illegal upfront fees from 2015 to 2022. This action violated the Telemarketing Sales Rule, as the company filed paperwork on behalf of consumers for programs that were actually available for free from the United States Department of Education.

Additionally, from 2018 to 2022, Performance Settlement used deceptive tactics to persuade consumers referred by OneLoanPlace.com to sign up for its services, violating the Consumer Financial Protection Act.

Compensation checks will be sent to affected consumers on February 15, 2024, through RUST Consulting. If you have questions about receiving a refund, you can contact performance_info@rustcfpbconsumerprotection.org or call 1 (888) 396-6086.

The total distribution amount of $10,936,618 will be disbursed from the CFPB’s victims relief fund and CFPB-administered redress.

The CFPB filed a complaint in the federal district court for the Central District of California on November 5, 2020, against Performance SLC, LLC, Performance Settlement, LLC, and Daniel Crenshaw, the owner and CEO of the two companies. The complaint alleged that Performance SLC and Crenshaw charged consumers with federal student loans illegal upfront fees and used deceptive sales tactics to sign consumers up for debt relief services, in violation of the Consumer Financial Protection Act of 2010 (CFPA).

The district court’s order in 2022 imposed civil penalties on Crenshaw and the companies and required redress to be paid to affected consumers. The order permanently bans PSLC from debt relief services, bans Crenshaw from debt relief services for five years, and permanently enjoins PSettlement from obtaining referrals from companies purporting to make or arrange loans.

For more information about the distribution and the case, visit the CFPB’s official website.