Nvidia and Lucid Motors Stocks Face Challenges as Bullish Bets Reach Crowded Levels

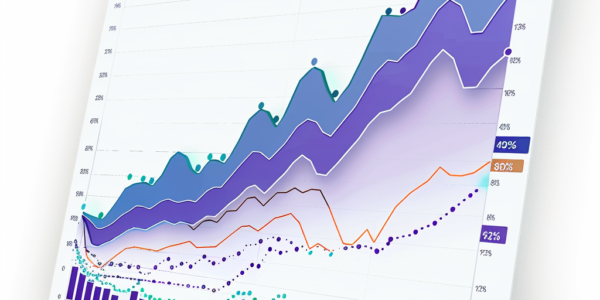

Wall Street is abuzz with comparisons between Nvidia and dot-com-era Cisco. Lucid Motors stock drops as losses mount for the EV startup. Bullish bets on Nvidia and other ‘Magnificent Seven’ members are nearing their most crowded levels, raising concerns among options-market experts about potential problems for the broader market. Market-data firm Spotgamma indicates that risky bullish options tied to the ‘Magnificent Seven’ and other market-leading technology stocks are approaching their most crowded levels in the past year. Derivatives-market experts warn of a potential pullback in the broader equities market, particularly for Big Tech stocks. Nvidia has been the best-performing stock in the S&P 500 so far in 2024, with a 46.7% increase this year following a 238% advance in 2023.

Prominent Investors Make Significant Changes to Stock Holdings in Q4 2024

Prominent investors made significant changes to their stock holdings in the fourth quarter of 2024, revealing their strategies and market sentiment. The filings show increased interest in tech stocks, particularly those related to artificial intelligence, while some investors shifted focus to energy and utilities companies. Consumer-related stocks witnessed a decline in interest among investors. Overall, the disclosures offer valuable insights into the evolving market trends and investment strategies.

Investors Await Strong Earnings Momentum from Tech Giants

Investors are eagerly awaiting the quarterly results of three companies that are expected to show strong earnings momentum. Nvidia is one of the major players that could see a substantial post-earnings surge this week. Additionally, there are stocks that have a track record of surpassing expectations and experiencing gains after reporting their earnings. On the other hand, Wolfe Research has identified stocks that investors should consider betting against. As the market prepares for these significant earnings announcements, investors are closely monitoring the performance of these companies.

Dallas-Fort Worth Restaurants and Bars Celebrate National Margarita Day with Specials and Deals

National Margarita Day is approaching on Feb. 22, and Dallas-Fort Worth is gearing up with a variety of specials and deals at restaurants and bars. From $3 margaritas and wells at Blue Goose Cantina to $5 top-shelf margaritas at Blue Mesa Grill, there’s something for every margarita lover to enjoy. Even breweries and Mexican Sugar are getting in on the celebration with themed menu items and margarita specials.

Palo Alto Networks Shares Plummet by 25% After Revenue Warning

Palo Alto Networks shares have plummeted by 25% after a revenue warning, raising concerns about the cybersecurity market. Investors and analysts are closely monitoring the situation, with ripple effects expected across the industry.

CFPB Takes Action Against Performance SLC and Performance Settlement for Deceptive Practices

Over 8,500 consumers affected by Performance SLC and Performance Settlement will receive over $10.9 million in compensation due to illegal and deceptive practices. The Consumer Financial Protection Bureau (CFPB) took action against these companies for charging illegal upfront fees and using deceptive tactics. If you have questions about receiving a refund, you can contact performance_info@rustcfpbconsumerprotection.org or call 1 (888) 396-6086.

Unseenlabs to Expand Maritime Surveillance Constellation with Launch of 12th and 13th Nanosatellites

French maritime surveillance provider Unseenlabs is expanding its satellite constellation with the launch of its 12th and 13th nanosatellites, bringing the company halfway towards its goal of offering near-real-time maritime surveillance services by the end of 2025. The new satellites, BRO-12 and BRO-13, are set to be integrated and launched on a Falcon 9 from Vandenberg Space Force Base in California. Unseenlabs’ current network of 11 satellites can monitor and track signals from ships across the world’s oceans every four to six hours, providing valuable data for commercial and government customers. The company plans to launch a total of six satellites in 2024, with a proposed constellation of 25 satellites by 2025, enabling a revisit time of around 30 minutes over the same area to enhance its services for real-time environmental monitoring, rapid response to maritime disasters, and live tracking of pollutant emissions.

Teladoc (NYSE:TDOC) Misses Q4 Sales Targets, Stock Drops 13.2%

Teladoc Health (NYSE:TDOC) disappoints in Q4 FY2023 with 3.6% revenue growth, falling short of analyst estimates. The stock drops 13.2% as next quarter’s revenue guidance also misses expectations. With a market capitalization of $3.48 billion, the telemedicine platform faces questions about its future sales growth.

U.S. Bank Branch in Downtown Roseburg to Permanently Close on April 29

The U.S. Bank branch in downtown Roseburg is set to permanently close on April 29, marking the end of an era for the longstanding financial institution in the area. The closure will impact the local community’s access to banking facilities and reflects the evolving dynamics of the banking industry. As the closure date approaches, customers and stakeholders will need to make alternative arrangements, sparking conversations about the future of banking services in the region.

SolarEdge Technologies Faces Stock Drop After Disappointing First-Quarter Guidance

SolarEdge Technologies faces a significant drop in stock value after disappointing first-quarter guidance, with revenues well below expectations. CEO Zvi Lando remains optimistic about the future, but challenges in the European and U.S. residential solar markets raise concern within the investment community.