A recent pullback has left National Grid shares looking cheap. Here’s why I think this might be one of the FTSE 100’s best income stocks.

Make money on autopilot? That’s the general idea with passive income. And if I wanted to earn an income without doing anything at all, a recent pullback has made National Grid (LSE: NG) shares look very cheap.

Let’s say I wanted to target a £100 monthly income stream. I’d want to hold it for decades and see my income rise slowly along the way. Well, cheap shares in this company might be just the ticket.

Why National Grid? Well, a stuttering share price has pushed the dividend yield to a near 10-year high, while the firm now trades at less than five times earnings.

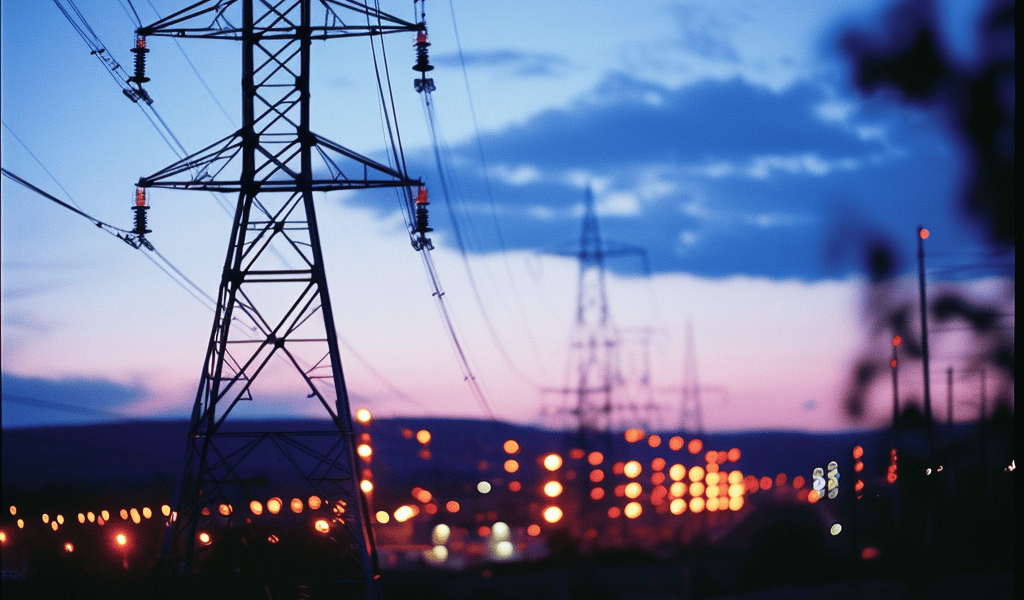

Aside from the cheap entry point, the nature of the business is great for seekers of passive income. The firm manages the UK’s electricity grid along with some US operations and essentially runs a monopoly on its service.

Say the word ‘monopoly’ and you might think of the argument-causing tabletop board game. Monopolies don’t tend to exist in the real world without coming under regulatory oversight very quickly, but monopolies are around and National Grid is one.

Monopoly status comes with limitations. The energy supplier isn’t allowed to set prices, for example. It comes with benefits too, like having extremely stable revenue from a lack of competition.

Consistent income streams allow National Grid to spend most of its earnings on dividends. Last year, around 82% of profits were paid to shareholders.

As for the dividend itself, it’s been pushed up recently and a 5.56% yield is close to a 10-year high. I’d expect my passive income to continue rising, too, with forecasts showing a 5.85% yield for 2024 and a 6.01% yield for 2025.

So the yield I’d receive from this stock is higher than inflation, interest rates and the majority of the FTSE 100. Pair that with stable earnings and this seems like a no-brainer for an income seeker’s portfolio.

What about risks? Well, National Grid bears the responsibility of building infrastructure. This might be expensive as we transition to a greener energy supply.