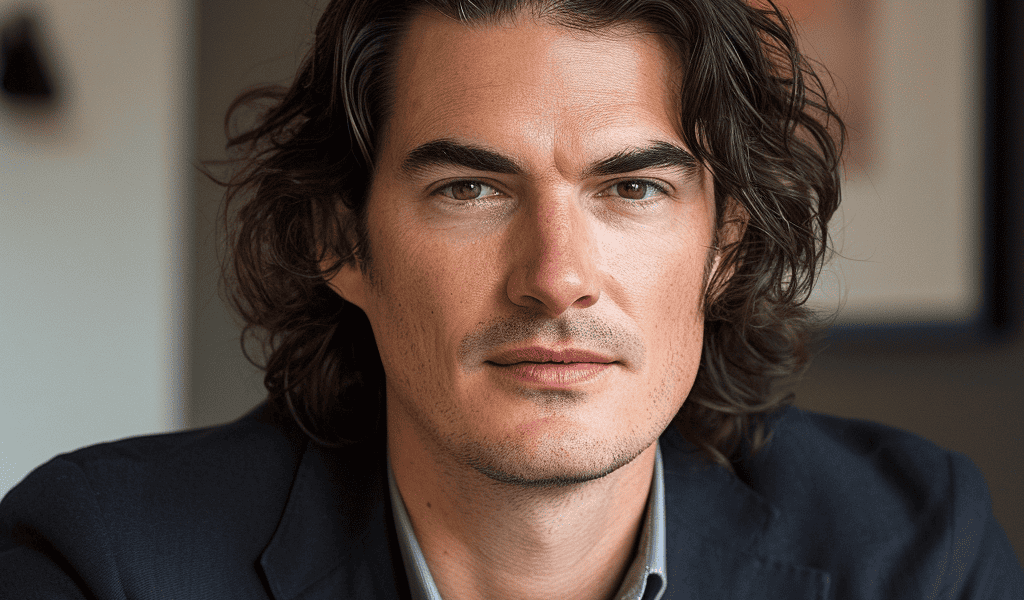

Adam Neumann, the co-working company’s onetime chief, has sought for months to buy the now-bankrupt business, but accuses its current leaders of stonewalling him.

WeWork’s founder is trying to buy it

Adam Neumann shot to fame by turning WeWork into a cultural and business phenomenon, before being ousted from the work space operator in dramatic fashion.

But for the past several months, he has been trying to buy the now-bankrupt business — with the help of the hedge fund mogul Dan Loeb, DealBook is the first to report.

Neumann’s new real estate company Flow Global is pushing WeWork to consider its takeover approach, according to a letter his lawyers sent to WeWork’s advisers on Monday. Flow which has already raised $350 million from the venture capital firm Andreessen Horowitz, disclosed in the letter that Loeb’s Third Point would help finance a transaction. (Read the letter.)

Flow has sought to buy WeWork or its assets, as well as provide bankruptcy financing to keep it afloat.

But Flow’s lawyers accused WeWork of stonewalling for months. ‘We write to express our dismay with WeWork’s lack of engagement even to provide information to my clients in what is intended to be a value-maximizing transaction for all stakeholders,’ wrote the lawyers led by Alex Spiro of Quinn Emanuel, who also represents Elon Musk and Jay-Z.

It’s the latest twist for WeWork, which over its 14-year history became a symbol of venture capital excess. The company grew rapidly, becoming the biggest tenant in many major cities and attaining a paper valuation of $47 billion. And Neumann — backed by billions from the Japanese tech giant SoftBank — increasingly pitched it as a way to ‘elevate the world’s consciousness.’