Western Digital Corp (WDC) has long been a stalwart in the hardware industry, but recent insights from the GF Score suggest potential headwinds for the company. Despite a daily gain of 5.39% and a three-month change of 27.24%, the company’s rankings in financial strength, growth, and valuation have diminished, raising concerns about its future performance.

The GF Score, a stock performance ranking system developed by GuruFocus, indicates that Western Digital Corp may not live up to its historical performance. With a GF Score of 61 out of 100, the company is signaling poor future outperformance potential.

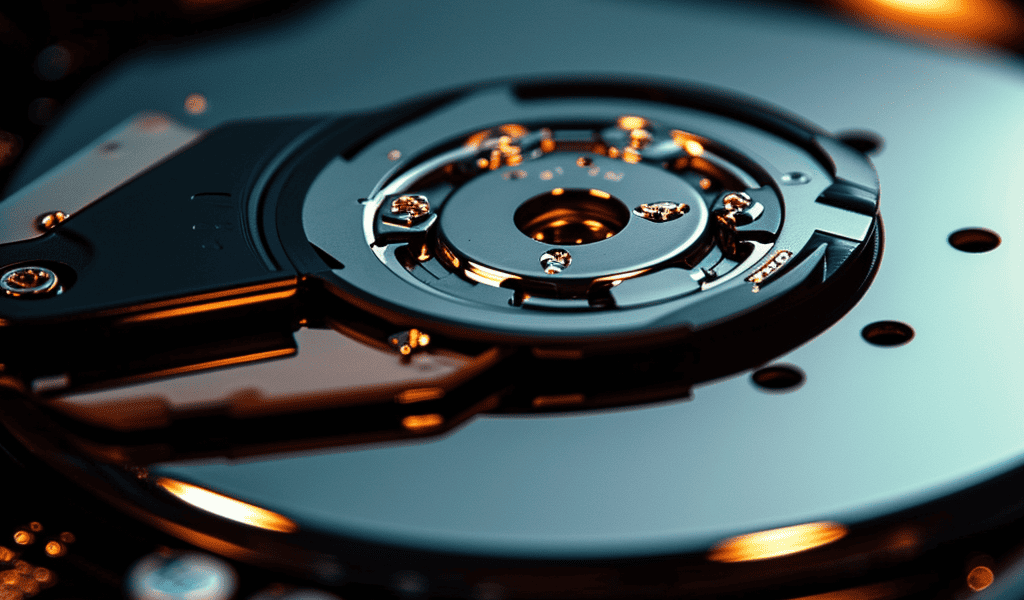

Understanding Western Digital Corp’s Business

Western Digital Corp is a leading supplier of data storage solutions, specializing in hard disk drives (HDD) and solid-state drives (SSD). With a market cap of $18.72 billion and sales of $11.33 billion, the company operates in a practical duopoly in the HDD market alongside Seagate. Additionally, it is the largest global producer of NAND flash chips for SSDs through a joint venture with competitor Kioxia. However, the company’s operating margin currently stands at -16, indicating potential challenges in profitability.

Financial Strength Breakdown

Western Digital Corp’s financial strength indicators reveal concerning insights about the company’s balance sheet health. With an interest coverage ratio of 0, the company is positioned worse than 0% of 1,577 companies in the Hardware industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. Furthermore, the company’s Altman Z-Score of 1.45 is below the distress zone of 1.81, suggesting potential financial difficulties.