Jane Lauder to Depart Estée Lauder Amid Leadership Changes

Jane Lauder, a key leader at Estée Lauder and granddaughter of the founder, announces her departure from the company as it navigates significant leadership changes. This transition follows CEO Fabrizio Freda’s planned retirement in 2025 and comes amid financial challenges, including a 2% decline in organic sales. Lauder, who has been with the brand since 1996, will remain on the board and serve as an advisor to the new CEO. As Estée Lauder seeks to adapt to market shifts, stakeholders are keenly watching for the next steps in its leadership evolution.

Bitcoin Drops 2.5% Amid FBI Investigation into Tether

Bitcoin’s value has dropped 2.5% to $66,450 amid an FBI investigation into Tether for potential sanctions violations. As the world’s most traded stablecoin faces scrutiny over alleged links to criminal activities, the cryptocurrency market experiences increased volatility. With Tether’s daily trading volume at $190 billion, the outcome of this investigation could significantly impact the future of stablecoins and the broader crypto ecosystem.

Elliott Management Acquires Stake in Starbucks, Aiming for Transformative Changes

Elliott Management Corporation has made a significant investment in Starbucks, aiming to influence the company’s operations and strategic direction. This move could lead to operational improvements, innovative menu offerings, and an aggressive expansion strategy, positioning Starbucks for growth in a competitive coffee market. As the coffee giant navigates post-pandemic challenges, Elliott’s involvement may expedite its recovery and enhance shareholder value.

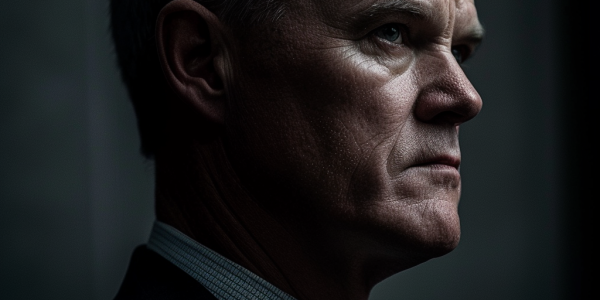

Boeing CEO Faces Senate Panel Amidst Whistle-Blower Allegations and Successor Uncertainty

Boeing CEO Dave Calhoun faces Senate panel amidst new whistle-blower allegations and uncertainty over his successor. Reports indicate Boeing is struggling to find a suitable replacement, highlighting the challenges ahead for the iconic American corporation. Lawmakers express dissatisfaction with Boeing’s safety response in the wake of past crashes.

Boston Beer In Talks To Sell: What Investors Need To Know

Boston Beer Company, owner of Samuel Adams and Truly Hard Seltzer, is in talks to sell itself to a larger spirits company, potentially valued at a premium to its current market capitalization. The potential acquisition by Suntory, owner of Jim Beam, could be a significant change for the well-known beer stock. Boston Beer shares surged on the news, with founder Jim Koch’s approval necessary for any deal to proceed.

Wall Street Journal Staffers Prepare for Walkout Amid Layoff Rumors

IAPE 1096 union members at Wall Street Journal are planning a walkout in response to rumors of layoffs in the U.S. News department. The union is concerned about the treatment of colleagues during previous layoffs and is urging employees to join a lunchtime walkout on May 30. Remote employees can participate virtually and show solidarity by setting out-of-office messages. Subscribe to Talking Biz News for more industry updates.

US Regulators Join Probe into Morgan Stanley’s Wealth Management Division

US regulators have joined the ongoing probe into Morgan Stanley’s wealth management division, reflecting increased scrutiny in the financial services industry. The involvement of additional US regulators underscores the focus on potential misconduct and compliance issues within the sector, highlighting the heightened scrutiny faced by major financial institutions. The probe is expected to shed light on the regulatory landscape governing wealth management activities and may have broader implications for industry practices.

Spirit AeroSystems Sees Surge in Shares Amid Potential Acquisition by Boeing

Spirit AeroSystems experiences surge in shares as potential acquisition by Boeing is reported, amid Boeing’s safety crisis. Talks between the two companies come as Boeing faces scrutiny over a recent incident and quality control issues at Spirit. A potential reunion between Boeing and Spirit signifies a significant shift in the aviation industry.

UnitedHealth Group Inc. Faces Antitrust Investigation Impacting Stock

Insurer Lemonade warns of decreased profits due to increased spending, while UnitedHealth Group Inc. faces an antitrust investigation, causing its stock to fall. The Justice Department is examining the relationships between UnitedHealthcare and its Optum units, focusing on the impact of acquisitions on competitors and consumers. With a significant market presence, UnitedHealth has been under regulatory scrutiny before, and its recent stock drop and ongoing investigation are of interest to investors and industry observers.

Walmart in Talks to Acquire Vizio’s TV Business for $2 Billion

Walmart is reportedly in talks to acquire Vizio’s TV business for $2 billion, potentially positioning itself as a rival to Roku and Amazon in the affordable smart TV market. The acquisition could grant Walmart access to Vizio’s customer data and revenue stream from personalized ads and subscription fees. This move comes as Roku and Amazon have been expanding their smart TV offerings, with Walmart already active in the advertising space. If the deal goes through, it could reshape the competition in the smart TV market.