Pinterest Shares Plummet After Disappointing Forecast and Revenue Report

Pinterest shares took a hit in extended trading on Thursday following a weaker-than-expected forecast and disappointing revenue report. Despite a 12% rise in revenue from the previous year, Pinterest’s net income stood at $201 million, or 29 cents per share, compared to $17.49 million, or 3 cents per share, in the previous year. The platform’s monthly active users in the fourth quarter increased by 11% to 498 million, surpassing analyst estimates of 487 million. However, the global average revenue per user fell short of expectations at $2, lower than the projected $2.05. Following the earnings report, Pinterest’s stock initially plummeted by as much as 28% to an after-hours low of $29.40. However, the announcement of a new Google partnership during a call with analysts led to a rebound, with the stock settling at a nearly 8% decline at $37.82. Pinterest CEO Bill Ready highlighted the potential of the Google partnership to improve monetization in international markets, citing the company’s under-monetization, particularly outside the U.S., where 80% of its users contribute to only 20% of its revenue. Pinterest’s report comes amidst a rebound in the digital advertising market, with Meta, Alphabet, and Amazon all demonstrating double-digit growth in their ad businesses.

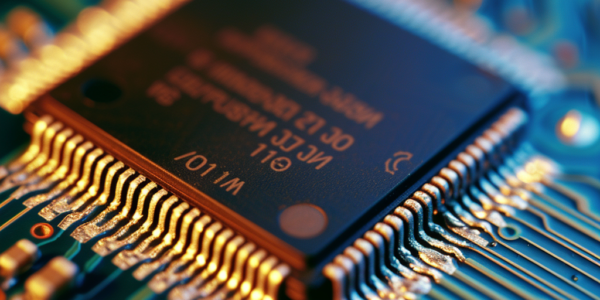

Taiwan Semiconductor Stock Sees Significant Rally After Q4 Results

Taiwan Semiconductor stock (NYSE:TSM) is poised for accelerating growth despite facing hurdles due to fluctuations driven by cyclical trends. The company’s advancements in chip innovation, particularly with 3-nanometer technology, promise a positive multi-year outlook for revenues and earnings, positioning TSM for substantial growth rebound from the temporary impact of industry cyclicalities. As a major player in the semiconductor industry, TSM’s progress in advancing chip fabrication makes it a bullish prospect for investors.

Stocks Making Waves in Premarket Trading: Disney, PayPal, Arm, and More

Investors are closely monitoring Disney, PayPal, and Arm as they show early signs of volatility in the premarket session. Disney’s recent earnings report and streaming subscriber numbers, PayPal’s navigation of the fintech landscape, and ongoing developments in the tech industry for Arm are all contributing to the movement of these key stocks.

Bireme Capital’s Fourth Quarter 2023 Investor Letter and Top Stock Picks

Read Bireme Capital’s fourth-quarter 2023 investor letter and find out about their fund’s performance, top holdings, and insights on stocks like Arm Holdings plc (NASDAQ:ARM). Discover why the firm bet against Arm Holdings plc and their analysis of the company’s valuation and market performance.

Snap Inc. Stock Plummets by 30% Following Significant Rally

Snap Inc.’s stock plummeted by 30% in Wednesday’s trading, leaving analysts puzzled by the rollercoaster ride of the company’s performance. Analysts express dismay and skepticism about Snap’s competitive position and financial prospects, as the stock witnesses a sharp decline following disappointing earnings report.

Jack Ma and Joe Tsai Make Significant Insider Buys in Alibaba

Jack Ma and Joe Tsai’s significant investment in Alibaba, totaling at least $200 million, has sparked a rally in Chinese internet stocks. Financial journalist A.J. Button highlighted the impact of the insider buys, triggering interest and discussions within the investment community. Stay tuned to leximural.com for more news and analysis on investment opportunities.

ELF Beauty Gears Up for Upcoming Earnings Report

ELF Beauty (ELF) is set to report its fiscal third-quarter results on February 6, with analysts expecting a significant increase in profit and revenue. The company’s stock has shown strong momentum in recent months, with a solid rally and positive technical indicators. ELF Beauty’s upcoming earnings report is eagerly anticipated by investors and analysts as the company continues to capture attention with its positive performance.

Stocks Show Significant Movement in Midday Session

Stocks in the midday session showed significant movement today, with Palantir, Spotify, UPS, and DocuSign making headlines. Palantir’s stock surged after a new partnership announcement, while Spotify faced increased volatility. UPS and DocuSign also experienced fluctuations, reflecting the dynamic movements in the stock market.

Stock Market Shows Positive Signs as Tech Stocks Lead Fourth Week of Gains

Good news for investors! The stock market is showing positive signs as tech stocks led the markets to a fourth week of gains. The S&P 500 closed out last week with another new high, lifted by tech stocks. The index…

Super Micro Computer to Purchase Former Fry’s Electronics Site in San Jose for $80 Million

A recent deal has been struck in San Jose as Super Micro Computer, a tech company experiencing a surge in sales, has agreed to purchase the former site of Fry’s Electronics for approximately $80 million. The property, located in North…