Naples Global Advisors LLC Reduces Holdings in Colgate-Palmolive

Naples Global Advisors LLC reduces holdings in Colgate-Palmolive by 3.4% in the fourth quarter, while other hedge funds make adjustments. Insider activity includes recent sales by Jennifer Daniels and CEO Noel R. Wallace.

European Defense Industry Poised for Growth Amidst Increased Spending

The European defense industry is set to benefit from increased spending as the continent looks to strengthen its military capabilities. The European Commission’s plan to enhance its defense industrial capacity could leave the UK at a disadvantage, especially with key elections looming. With the urgency surrounding defense expenditure coming to the forefront, European Commission President Ursula von der Leyen has emphasized the need for Europe to ramp up its defense industrial capacity over the next five years. The call for heightened defense spending in Europe is indicative of the significant role that border defense is likely to play in upcoming elections, with far-reaching implications on geopolitical dynamics and defense strategies.

Resurgence of Meme Investments in 2024

Meme investments are making a comeback in 2024, driven by speculative fervor and the resurgence of assets lacking intrinsic value. Traditional meme investments like gold and Bitcoin are surging, alongside newer meme coins like bonk. The AI industry is also experiencing speculative activity, with Reddit set to go public. Exorbitant amounts of money are being spent on non-traditional assets, reflecting a preference for high returns despite higher risk. The enduring appeal of speculative assets and pursuit of significant returns continue to drive the evolution of investment trends and market dynamics.

Stocks Set to Make Significant Moves in Premarket Trading

Stocks like Micron, Apple, Astera Labs, and Broadcom are set to make significant moves in the premarket. Micron’s strong earnings and revenue report, Apple’s plans to increase iPhone production, Astera Labs’ IPO, and Broadcom’s share buyback program are all driving market activity today.

Three Short-Squeeze Stocks to Watch Beyond the Reddit IPO

Get ready for the next big short-squeeze opportunity in the stock market. Intuitive Machines (LUNR), Desktop Metal Inc (DM), and Blink Charging (BLNK) are three stocks with significant potential for short-squeeze and long-term investment success. While the Reddit IPO is creating buzz, these companies offer compelling standalone investment opportunities.

Investors Make Significant Changes to Micron Technology, Inc. (NASDAQ:MU) Holdings

Sunbelt Securities Inc. sells 179 shares of Micron Technology, Inc., reducing its stake by 10.1%. State Street Corp, FMR LLC, Capital World Investors, Geode Capital Management LLC, and Wellington Management Group LLP also make changes to their positions in the stock. MU stock opened at $93.25 on Monday, trading up 2.0% with a 52-week low of $53.61 and a high of $101.85.

Risks and Rewards of Investing in AI Stocks

Artificial intelligence (AI) has been a driving force behind the recent surge in the stock market, with companies like Palantir, C3.AI, and Snowflake reaping the benefits. However, as the market continues to soar, analysts are warning of potential risks associated with investing in AI stocks. Recent reports from Nvidia (NASDAQ:NVDA) have further fueled the AI boom, with a staggering 265% increase in revenue year over year. This has led to a significant rise in investor confidence, highlighting the pivotal role of AI in shaping market dynamics. However, with nearly two-thirds of the S&P 500’s gains in 2023 attributed to tech companies, concerns have been raised about the sustainability of AI technology’s profitability. Palantir, C3.AI, and Snowflake are facing challenges in maintaining their momentum in the AI market, prompting caution among investors.

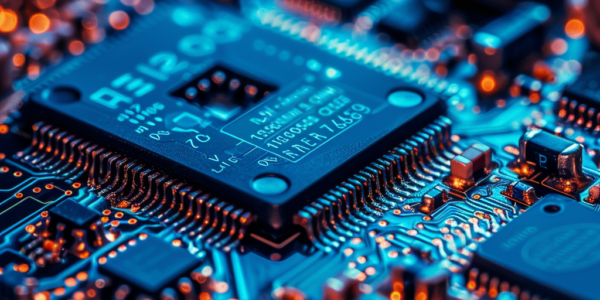

Exploring Alternative Chip Stocks for Investment Opportunities

Looking for alternative chip stocks to invest in? Consider ASML, GlobalFoundries, and Skyworks Solutions as promising options with potential for growth and value. These lesser-known companies offer attractive opportunities for investors seeking exposure to the semiconductor sector without paying premium valuations.

Google’s Strong Performance and Resilience in the Tech Industry

Google continues to demonstrate strong performance in both its top and bottom lines, with significant growth driven by its cloud revenue. The tech giant remains a key player in the Fab 7, showcasing resilience and strategic positioning in the industry.

Fisker Hires Restructuring Advisers Amid Bankruptcy Concerns

Fisker, the electric vehicle manufacturer, is reportedly considering bankruptcy filing amidst challenges including potential delisting, doubts about continued operation, and significant costs. Despite a 300% increase in deliveries, Fisker is seeking outside investment and a potential partnership with Nissan for electric trucks. Plans for new vehicle designs have been unveiled, but the company has faced setbacks leading to a potential bankruptcy filing and a decline in after-hours trading.