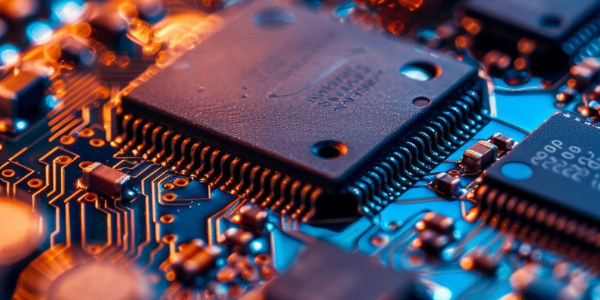

South Korea to Invest $10 Billion in Semiconductor Industry by 2025

South Korea is set to invest $10 billion in fiscal support for its semiconductor industry in 2025, aiming to strengthen its position amid rising international competition and potential policy shifts from the upcoming U.S. administration. This strategic initiative will enhance innovation, production capacities, and ensure the country’s competitiveness in the global semiconductor market.

Tropical Storm Helene Disrupts High-Purity Quartz Supply in Spruce Pine, Impacting Semiconductor Industry

Spruce Pine, North Carolina, faces challenges following Tropical Storm Helene, impacting its crucial role in the global semiconductor supply chain. Home to high-purity quartz, essential for semiconductor manufacturing, the town’s recovery is vital for maintaining steady chip production amid rising demand. With operations temporarily halted by The Quartz Corp and Sibelco, experts warn of potential supply chain disruptions if delays extend. The aftermath of the storm highlights the interconnectedness of local economies and global industries, emphasizing the importance of Spruce Pine in the tech sector.

Mach42 Forms AI Advisory Board to Revolutionize Semiconductor Design

Mach42, formerly Machine Discovery, has launched an AI Advisory Board to enhance semiconductor design capabilities. Led by industry experts Dr. Antun Domic and Professor Yarin Gal, this initiative aims to leverage AI for faster, more efficient product development in the semiconductor industry. The advisory board will guide Mach42 in innovating AI-driven solutions that transform design and verification processes, positioning the company as a leader in the evolving semiconductor landscape.

Finding Value in Semiconductor Stocks for Investors

Looking for cheap semiconductor stocks to invest in? Discover hidden gems in the market like Qualcomm, Applied Materials, and Taiwan Semiconductor. With the AI revolution in full swing, these companies offer promising growth potential for savvy investors. Don’t overpay for overhyped stocks – focus on value and strategic partnerships to capitalize on future gains in the semiconductor sector.

DRAM Manufacturers Resume Production After Earthquake Impact

DRAM manufacturers are gradually resuming production following an earthquake, with minimal impact on total Q2 DRAM output estimated to be less than 1%, according to TrendForce. Major producers like Micron have resumed full operations, with advancements in cutting-edge technologies expected to impact bit production. The earthquake has led to temporary halts in quotations for DRAM markets, with contract prices expected to rise. Server DRAM prices may be affected by the earthquake, but stable supply levels are ensured. Overall, the earthquake’s impact on DRAM production is limited, with spot market prices remaining relatively stable.

Taiwan’s Earthquake and the Fragility of the Global Tech Industry

Taiwan’s earthquake on April 3 had minimal casualties thanks to strong building codes and earthquake preparation. The island’s semiconductor industry, crucial to the global tech industry, largely emerged intact, but the fragility of these nodes in the global economy is a reminder of their importance.

The World’s Only Producer of Quartz for Semiconductor Manufacturing

Two mines in North Carolina are the world’s only producer of the quartz necessary for semiconductor manufacturing. If they were to stop operating, it would mean a few years of catastrophic disruption, says Wharton professor Ethan Mollick. Spruce Pine, a small town in North Carolina, is home to these crucial mines, which are the sole supplier of the quartz required to make the crucibles needed to refine silicon wafers. The importance of these mines to the global semiconductor industry and solar photovoltaic markets has been highlighted in various media and publications.

Exploring Alternative Chip Stocks for Investment Opportunities

Looking for alternative chip stocks to invest in? Consider ASML, GlobalFoundries, and Skyworks Solutions as promising options with potential for growth and value. These lesser-known companies offer attractive opportunities for investors seeking exposure to the semiconductor sector without paying premium valuations.

Samsung Electronics Plans to Rename Its Second-Generation 3nm Process to ‘2nm’

Chinese foundries in the semiconductor industry are facing challenges due to overexpansion, while Samsung Electronics plans to rename its second-generation 3nm process to the ‘2nm’ process, with mass production expected to commence in the second half of 2024. Samsung’s rebranding aims to enhance marketing efforts for its foundry services, and the move to consolidate the 2nd-gen 3nm and 2nm processes suggests accelerated mass production of 2nm chips. Intel’s advanced process technology roadmap also demonstrates intense competition within the semiconductor industry, with both Samsung and Intel vying for leadership in advanced process technologies.

Is the United States on the Brink of a Semiconductor Manufacturing Boom?

The $1.5 billion grant to chipmaker GlobalFoundries by the White House has sparked discussions about the potential revitalization of research and manufacturing of semiconductors in the United States. Despite delays in expansion plans, major semiconductor producers in the U.S. have several significant developments underway, with estimated costs ranging from $17.3 billion to $20 billion. The focus on cutting-edge logic chips with 5 nm and 3 nm process nodes reflects the country’s pursuit of technological independence and potential resurgence in the industry.