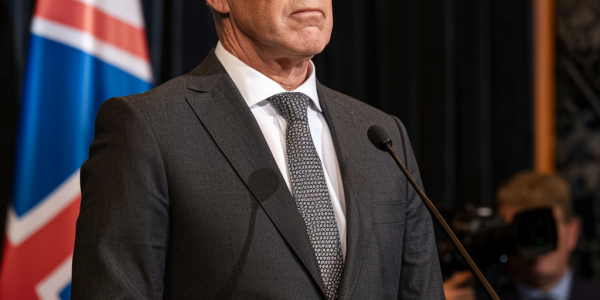

New Zealand PM Defends Economic Strategy Ahead of Key Fiscal Update

New Zealand Prime Minister Christopher Luxon defends his coalition government’s economic growth amid fiscal responsibility concerns. As the Treasury’s half-year fiscal update approaches, Luxon emphasizes commitment to achieving a budget surplus despite economic challenges. Finance Minister Nicola Willis signals a cautious approach, prioritizing prudent fiscal decisions over strict surplus targets. The upcoming update is expected to shape the government’s economic strategy as New Zealand navigates a complex financial landscape.

TD Securities Revises Cash Rate Calls for RBA and RBNZ

TD Securities economists revise cash rate calls for RBA and RBNZ, predicting RBA easing in November and RBNZ hike of 25 basis points. RBNZ expected to implement aggressive easing cycle, while RBA projected to make 100 basis points of cuts. Forward-looking statements provided for informational purposes only. Investing in open markets carries significant risks.

Controversy Surrounds Australian Interest Rate Proposal

Australian interest rates have once again sparked controversy, with Wazza McKibbin’s recent comments drawing attention. McKibbin’s proposal for a neutral interest rate has raised concerns about its impact on households, with critics arguing that such a rate would be detrimental….