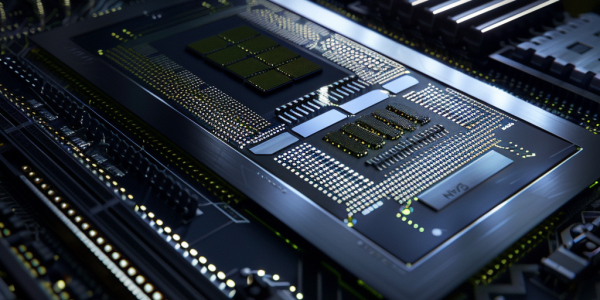

Nvidia Reports 94% Revenue Surge Driven by AI Demand

Nvidia’s third-quarter earnings reveal a remarkable 94% year-over-year revenue increase, reaching $35.08 billion, driven by soaring demand for AI technology. Despite a slight decline in shares post-announcement, the company’s data center business generated $30.8 billion in sales, showcasing its leadership in the AI market. With a promising forecast of $37.5 billion in sales for the current quarter, Nvidia continues to solidify its position as a key player in the rapidly growing AI sector.

Nvidia’s Recent Advancements and Market Performance

Nvidia’s recent advancements in AI and market performance have analysts raising price targets, with the company’s stock soaring by 9%. Despite CEO stock sales, Nvidia’s market cap surpasses Apple’s, with plans to launch an advanced AI platform and establish a computing center in Taiwan. The recent stock split positions Nvidia for potential inclusion in the Dow 30 index, opening up new opportunities for the tech giant.

Tech Giants Apple and Nvidia Prepare for Major Developments

Exciting times are ahead for tech enthusiasts as Apple and Nvidia gear up for major developments that could potentially impact their stock performance. With both companies set to unveil significant news in the coming days, investors are eagerly anticipating the potential catalysts that could drive their stocks to new heights. Apple is expected to announce groundbreaking artificial intelligence capabilities at its WWDC, while Nvidia is preparing for a 10-for-1 stock split. The imminent developments for both companies have investors questioning whether now is the right time to buy their stocks, as the market buzzes with speculation and excitement.

Nvidia vs. Snowflake: Contrasting Performances in the AI Trend

Discover how Nvidia and Snowflake’s contrasting performances in the AI sector highlight the importance of aligning with market trends. While Nvidia’s stock has soared by nearly 600% in the last three years, Snowflake’s has declined by 40%, showcasing the benefits of strategic positioning within the industry. Learn how businesses can capitalize on major trends to drive growth and success in the stock market.

Elon Musk’s xAI Raises $6 Billion, Boosting Nvidia’s Stock Value

Elon Musk’s xAI start-up raising $6 billion in capital signals a potential partnership with Nvidia, boosting the tech company’s stock value by 7%. With Nvidia’s revenue projected to double, the collaboration underscores the growing demand for Nvidia’s GPUs in the AI market, solidifying its market dominance.

Nvidia Announces 10-for-1 Stock Split Amid AI Technology Boom

Tech giant Nvidia announces a 10-for-1 stock split following a surge in share price driven by AI technology. The split aims to make ownership more accessible, appealing to both employees and investors. With a remarkable 25-fold increase in share price over the past five years, Nvidia solidifies its position as a key player in the AI hardware market.

Nvidia set to release fiscal Q1 2025 earnings amidst investor concerns

Investors are eagerly awaiting Nvidia’s fiscal Q1 2025 earnings, but concerns about a potential plateau in earnings growth linger. Despite uncertainties, discussions among hyperscalers suggest a positive long-term outlook. Analysts acknowledge the possibility of a slowdown due to a product transition, but maintain indicators point to robust growth. Nvidia’s performance is crucial for the future trajectory of the technology sector, with a strong quarterly showing expected to lead to a consolidation of gains in the AI sector.

Expert Advice: Investing in AI Plays Amidst Market Fluctuations

BlackRock’s Kate Moore suggests that the recent market pullback is merely a ‘healthy consolidation’ and advises investors to utilize this opportunity to invest in artificial intelligence (AI) plays. As India gears up for elections, professionals are eyeing eight top stocks for potential investment opportunities. Diversifying beyond popular choices like Nvidia has proven to be a successful strategy for one investor, yielding exceptional returns. Investors are encouraged to stay informed and explore various investment avenues beyond traditional options.

Risks and Rewards of Investing in AI Stocks

Artificial intelligence (AI) has been a driving force behind the recent surge in the stock market, with companies like Palantir, C3.AI, and Snowflake reaping the benefits. However, as the market continues to soar, analysts are warning of potential risks associated with investing in AI stocks. Recent reports from Nvidia (NASDAQ:NVDA) have further fueled the AI boom, with a staggering 265% increase in revenue year over year. This has led to a significant rise in investor confidence, highlighting the pivotal role of AI in shaping market dynamics. However, with nearly two-thirds of the S&P 500’s gains in 2023 attributed to tech companies, concerns have been raised about the sustainability of AI technology’s profitability. Palantir, C3.AI, and Snowflake are facing challenges in maintaining their momentum in the AI market, prompting caution among investors.

Nvidia GTC: TechRadar Pro Anticipates Major AI Technology Developments

Stay updated with real-time announcements and news from Nvidia GTC in San Jose. With keynote address by CEO Jensen Huang, Nvidia is set to unveil its latest offerings in AI technology. TechRadar Pro is on the frontline, equipped with live updates and a video stream for visual accompaniment.