Palantir and MicroStrategy Set to Join Nasdaq 100 Amid Market Rebalancing

Palantir Technologies (PLTR) and MicroStrategy (MSTR) are set to join the Nasdaq 100, highlighting their growing significance in the tech sector. This inclusion, part of the Nasdaq’s annual rebalancing, reflects shifting market dynamics as both companies gain traction. Palantir’s market cap has soared to $169 billion, while MicroStrategy’s innovative Bitcoin strategy has captured investor attention. Stay updated on these developments as they signal potential growth and innovation in the tech industry.

MicroStrategy Options Activities Draw Attention from Investors

MicroStrategy, a prominent player in the enterprise analytics and mobility software industry, has recently attracted deep-pocketed investors with a flurry of extraordinary options activities. With projected price targets ranging from $600.0 to $3800.0, the market sentiment appears divided between bullish and bearish outlooks. Analyzing the volume and open interest trends for MicroStrategy’s options can provide valuable insights into market liquidity and interest levels.

MicroStrategy Announces Q1 2024 Financial Results and Bitcoin Holdings Growth

MicroStrategy Incorporated announces significant developments in its bitcoin holdings and business operations for the first quarter of 2024. With a substantial 214,400 bitcoins and a focus on financial market activities, advocacy efforts, and technological innovations, the company remains a key player in the digital assets and business intelligence landscape.

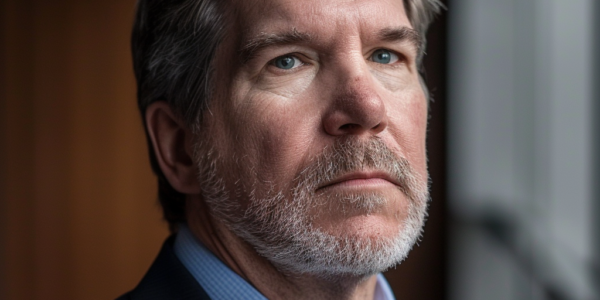

Michael Saylor Sells 5,000 Shares of MicroStrategy Inc (MSTR)

Michael Saylor, the Executive Chairman and 10% Owner of MicroStrategy Inc (MSTR), recently sold 5,000 shares of the company, part of a trend of insider selling. With a price-earnings ratio of 68.10, the recent insider sale may offer insights into the company’s valuation and future prospects, but investors are advised to conduct thorough research before making investment decisions.

Microstrategy Stock: Insider Selling Raises Concerns

Microstrategy (NASDAQ:MSTR) has garnered attention for its aggressive accumulation of Bitcoin, but recent insider selling activity has raised concerns among prospective investors. Despite the company’s substantial Bitcoin holdings, the decision of Microstrategy’s insiders to divest their shares prompts caution for those considering MSTR stock. Prudent investors are advised to approach MSTR stock with caution, considering the implications of insider selling on the company’s performance.

MicroStrategy Inc (MSTR) Surges 11.23% in Pre-Market Trading

MicroStrategy Inc (MSTR) saw an 11.23% surge in pre-market trading, with a short-term technical score of 75 indicating a bullish trend. Analysts recommend a Strong Buy with an average price target of $795.00. With an Overall Score of 58 and a Long-Term Technical rank of 99, MSTR is positioned as a top stock over the last 200 trading days. Stay informed with essential market news and insights by subscribing to the daily morning update newsletter.

MicroStrategy Adds 3,000 Bitcoin to Its Holdings, Bringing Total to 193,000 Coins

MicroStrategy, the largest corporate owner of bitcoin, has added 3,000 tokens to its cryptocurrency holdings, bringing its total to 193,000 coins. With an average price of $51,813 per coin, the company’s unrealized profit from its holdings stands at an impressive $3.8 billion.