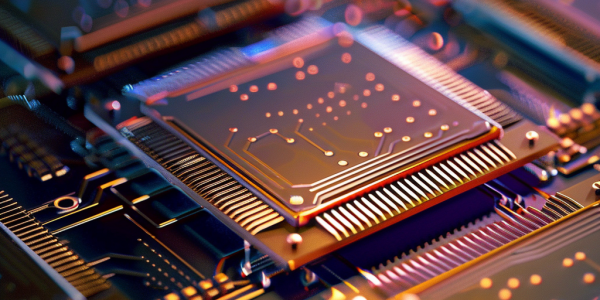

Intel’s Gaudi 3 Chip Projections Disappoint Investors

Intel’s Gaudi 3 chip falls short in sales projections compared to Nvidia, causing disappointment in the market. Despite underwhelming performance, Intel has promising products like the Lunar Lake lineup. Analysts have a consensus Hold rating on INTC stock, with potential upside of 29.15% based on an average price target of $39.96 per share.

Challenges Ahead for Tilray Brands in the Cannabis Industry

Investors considering Tilray Brands in light of potential U.S. marijuana legalization should be aware of the company’s cash flow challenges, potential stock dilution, strategic shifts towards cannabis, and risks associated with acquisitions. Legalization alone may not solve Tilray’s underlying issues, making careful consideration essential for investors.

Amazon set to announce first-quarter results with focus on AWS sales growth and AI demand

Amazon.com is set to announce its first-quarter results, with a focus on AWS sales growth and AI-related demand. Investors are eager for insights into the company’s guidance for the year and its future trajectory. With significant moves in various sectors, including expanding its Bedrock GenAI Service, Amazon’s earnings announcement is highly anticipated. As scrutiny on big tech companies continues, analysts and investors will closely watch Amazon’s financial results for signals of resilience and growth potential.

Stocks Experience Significant Movement in After-Hours Trading Session

Discover the significant after-hours stock movements of companies like Paramount, NXP Semiconductors, Chegg, and F5. Learn why monitoring after-hours trading activity is crucial for investors and how it can impact investment decisions.

Tesla Stock Surges After Analyst Sets Price Target

Stay updated with the latest news and developments in the stock market with free breaking news alerts! RBC Capital analyst Tom Narayan reiterates an Outperform rating for Tesla, leading to a 9% surge in stock. Wall Street sees positive trends with Tesla and Apple stocks gaining, investors await Federal Reserve’s decision. Jefferies forecasts S&P 500 fair value at 4900 with potential surge to 5400. Sign up for more exclusive stock market news articles like this on StreetInsider.com Premium!

Atlassian Stock Plummets Following Q3 Results

Atlassian’s stock price dropped by 9.56% after the release of its fiscal Q3 results, despite strong revenue growth. Analysts express concerns about future revenue potential as the company shifts focus to cloud services. Co-founder Scott Farquhar’s decision to step down as co-CEO raises unease among investors, but operational stability is expected to be maintained. With uncertainties surrounding its cloud growth, Atlassian remains optimistic about its long-term prospects amidst market volatility.

Biogen Surges, Mizuho Adjusts Outlook on Intel Corporation

Biogen’s earnings have surged by 4.56%, drawing the attention of investors. Mizuho adjusts Intel Corporation’s share price target from $55.00 to $45.00, despite maintaining a buy rating. Intel projects growth in PC and data center markets, with strategic advancements in server offerings and AI GPUs. Mizuho remains optimistic about Intel’s future, highlighting the tech giant’s potential in navigating market challenges and capitalizing on growth opportunities.

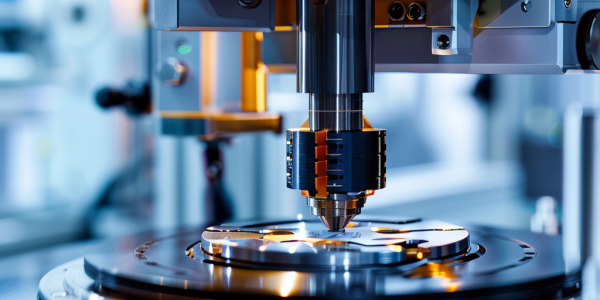

Lam Research Returns to Earnings Growth, Beats Expectations

Semiconductor equipment supplier Lam Research (LRCX) has returned to earnings growth, surpassing expectations for its fiscal third quarter. Despite declining sales, the company reported an 11% increase in earnings compared to the previous year. Lam Research CEO Tim Archer expressed optimism about the company’s performance, highlighting its strong start in calendar 2024. Stay updated on tech industry news and stock updates by following Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz.

Meta Platforms COO Sells Shares Amidst Insider Trading Plan

Meta Platforms, Inc. COO Javier Olivan recently sold 490 shares of Class A Common Stock, sparking investor questions about the company’s financial health and future. Stay informed about tech sector developments for investment opportunities.

Meta Set to Announce Strong First-Quarter Earnings Amidst Market Expectations

Meta, the parent company of Facebook, is expected to announce strong first-quarter earnings with significant year-over-year sales growth. Analysts project earnings per share of $4.32, revenue of $36.16 billion, 2.12 billion daily active users, and 3.09 billion monthly active users. CEO Mark Zuckerberg’s focus on efficiency and AI-driven ad business has propelled Meta’s stock value, despite challenges in 2022. Investments in AI models and tools have led to a 26% revenue increase, supported by increased spending from Chinese retailers. Investors are eager to see the impact of innovative advertiser tools and video monetization on Meta’s financial performance.