Five Key Updates Impacting Markets Ahead of Friday Trading

As the stock market opens on Friday, investors must consider five crucial updates: a market rotation impacting major stocks, a global cyber outage affecting airlines and banks, Netflix surpassing subscriber expectations, key economic indicators to watch, and fluctuating international market trends. Stay informed to navigate these developments effectively.

Spinnaker Investment Group Increases Microsoft Holdings Amid Institutional Buying Surge

Spinnaker Investment Group LLC has increased its Microsoft Corporation (NASDAQ:MSFT) holdings by 2.7% in Q1 2024, now owning 12,521 shares valued at approximately $5.3 million. This move reflects a broader trend of institutional investors boosting their stakes in Microsoft, with Vanguard Group also increasing its holdings significantly. Analysts remain optimistic, raising price targets for Microsoft, positioning it as a strong contender in the tech sector.

Five Below Searches for New CEO After Resignation of Joel Anderson

Five Below, a popular retailer, is in search of a new permanent CEO after Joel Anderson’s resignation. Kenneth Bull steps in as interim CEO, while Thomas Vellios becomes interim executive chairman. Despite a 5% decrease in sales, Five Below remains committed to growth and customer value. Stay updated on industry trends with us.

Meta Platforms, Inc. Makes Waves in Market with Recent Performance

Meta Platforms, Inc., formerly known as Facebook, saw a 5.87% increase in its stock price after market hours, closing at 539.9 USD on the Nasdaq. With recent insider share sales and positive market trends, the company is navigating through a dynamic market landscape. Stay tuned for upcoming earnings releases and international developments as tech companies like Meta Platforms, Inc. continue to innovate and grow amidst regulatory challenges.

Stock Yards Bank & Trust Co. increases position in Alphabet Inc. by 4.2% in first quarter

Stock Yards Bank & Trust Co. increases position in Alphabet Inc. by 4.2% in first quarter, now holding 535,521 shares valued at $80,826,000. Other notable investors like Vanguard Group Inc., Norges Bank, Fisher Asset Management LLC, and Charles Schwab Investment Management Inc. also made moves with Alphabet stock.

Koss Stock Surges Over 143% Amidst Short Squeeze Speculation

Headphone maker Koss (KOSS) experiences a remarkable surge in stock price, up over 143% today amid speculation of a short squeeze. Retail traders show keen interest, while institutional investors appear less enthusiastic. With trading volume far exceeding the average, KOSS attracts attention as a potential target for a short squeeze, despite the absence of direct mentions from meme stock influencers. As the meme frenzy resurfaces, KOSS emerges as a standout opportunity for traders seeking significant gains in the market.

Tesla Stock Rises After Analyst Ratings and Earnings Report

Tesla, Inc. (NASDAQ:TSLA) stock saw a significant increase, with analysts providing mixed ratings and price targets. The company’s performance metrics, including market capitalization and earnings, are also highlighted. Insider trading activity by Director Robyn M. Denholm is discussed as well.

Tech Stocks Embrace Dividends: OpenText Corp and Alphabet Leading the Way

Tech stocks like OpenText Corp and Alphabet (Google) are changing the game by offering dividends to investors. With Alphabet paying $0.20 per quarter and OpenText offering $0.25 per quarter, these tech companies are showcasing strong dividend growth potential. As the tech industry evolves, more companies may start offering dividends to attract investors seeking growth and income.

Los Angeles Capital Management LLC Acquires Significant Number of Shares in Super Micro Computer, Inc.

Los Angeles Capital Management LLC significantly increased their holdings in Super Micro Computer, Inc. by 482.6% in the 1st quarter, acquiring an additional 27,895 shares. Other institutional investors like Versant Capital Management Inc also raised their stakes in SMCI. Super Micro Computer’s stock has shown positive momentum with a recent 3.7% increase, boasting impressive financial performance with earnings per share surpassing expectations.

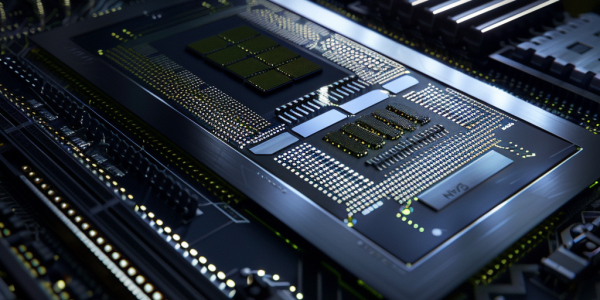

Nvidia’s Recent Advancements and Market Performance

Nvidia’s recent advancements in AI and market performance have analysts raising price targets, with the company’s stock soaring by 9%. Despite CEO stock sales, Nvidia’s market cap surpasses Apple’s, with plans to launch an advanced AI platform and establish a computing center in Taiwan. The recent stock split positions Nvidia for potential inclusion in the Dow 30 index, opening up new opportunities for the tech giant.