Microsoft Shareholders to Vote on Bitcoin Investment Proposal

Microsoft shareholders will vote on a proposal to consider adding Bitcoin to the company’s balance sheet on December 10, 2024. As Bitcoin’s value approaches $98,050, the proposal comes amid increasing corporate interest in cryptocurrency. Despite support from prominent figures, Microsoft’s board recommends a vote against the proposal, reflecting a cautious approach to crypto investments. The outcome could significantly impact corporate attitudes towards Bitcoin and the broader cryptocurrency market.

MicroStrategy Options Activities Draw Attention from Investors

MicroStrategy, a prominent player in the enterprise analytics and mobility software industry, has recently attracted deep-pocketed investors with a flurry of extraordinary options activities. With projected price targets ranging from $600.0 to $3800.0, the market sentiment appears divided between bullish and bearish outlooks. Analyzing the volume and open interest trends for MicroStrategy’s options can provide valuable insights into market liquidity and interest levels.

MicroStrategy Announces Q1 2024 Financial Results and Bitcoin Holdings Growth

MicroStrategy Incorporated announces significant developments in its bitcoin holdings and business operations for the first quarter of 2024. With a substantial 214,400 bitcoins and a focus on financial market activities, advocacy efforts, and technological innovations, the company remains a key player in the digital assets and business intelligence landscape.

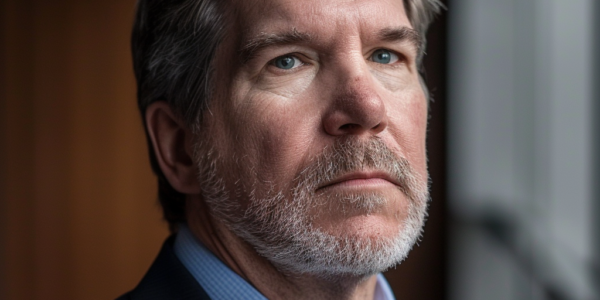

Michael Saylor Sells 5,000 Shares of MicroStrategy Inc (MSTR)

Michael Saylor, the Executive Chairman and 10% Owner of MicroStrategy Inc (MSTR), recently sold 5,000 shares of the company, part of a trend of insider selling. With a price-earnings ratio of 68.10, the recent insider sale may offer insights into the company’s valuation and future prospects, but investors are advised to conduct thorough research before making investment decisions.

MicroStrategy Adds 3,000 Bitcoin to Its Holdings, Bringing Total to 193,000 Coins

MicroStrategy, the largest corporate owner of bitcoin, has added 3,000 tokens to its cryptocurrency holdings, bringing its total to 193,000 coins. With an average price of $51,813 per coin, the company’s unrealized profit from its holdings stands at an impressive $3.8 billion.