Federal Court Blocks Tapestry-Capri Merger Amid FTC Concerns

A federal court ruling has blocked the $8.5 billion merger between Tapestry, owner of Coach, and Capri Holdings, parent of Michael Kors. Judge Jennifer Rochon’s decision, prompted by the FTC’s concerns over consumer impact, has led to a 10% rise in Tapestry’s stock while Capri’s shares plummeted by 50%. As Tapestry plans to appeal, the ruling raises critical questions about competition and market dynamics in the luxury fashion industry.

Kroger-Albertsons Merger Negotiations Stall Amid Regulatory Scrutiny

Negotiations between Kroger Co. and Colorado regulators regarding the $24 billion merger with Albertsons have stalled, raising concerns about competition and consumer choice in the grocery sector. As both parties seek to avoid a court hearing, the implications of this high-profile merger could reshape the grocery landscape and influence future mergers in the industry.

National Amusements Halts Merger Talks with Skydance Media

National Amusements, controlled by Shari Redstone, halts discussions with Skydance Media regarding a potential merger, impacting Paramount Global. Paramount’s shares decline by 10% following the news. Redstone now focuses on selling National Amusements separately, attracting interest from groups led by Steven Paul and Edgar Bronfman Jr. Former President Donald Trump to meet with GOP senators in Washington D.C. to discuss future plans. Israel claims Hamas rejected a proposal for hostages and ceasefire.

Reliance Industries Seeks Approval for $8.5 Billion Merger Involving Viacom18 and Star India

Reliance Industries seeks CCI approval for an $8.5 billion merger involving Viacom18 and Star India, aiming to solidify its position in the media industry. This strategic move could reshape the Indian media landscape, creating a powerhouse to compete with other major players. Industry experts anticipate innovative content offerings and compelling entertainment experiences for consumers as a result of this merger.

Paramount Global Potential Change of Control in the Works

Skydance Media, led by David Ellison, is looking to purchase $3 billion of Paramount shares to bolster the company’s financial position. The Redstone family may grant nonvoting shareholders a say in any transaction, with discussions ongoing. Paramount’s board is cautious in accepting the deal amidst significant shareholder unrest. Ellison’s offer includes acquiring controlling shares, injecting capital, and integrating Skydance into the company. The potential deal has faced opposition from shareholders concerned about diluting nonvoting stakes.

Donald Trump Receives Approval for Controversial Wall Street Comeback

Former President Donald Trump has received approval from US regulators for a controversial merger, potentially marking his comeback to Wall Street. The merger between Trump Media & Technology Group and a blank-check company has been given the green light by the SEC, with Trump holding a substantial stake potentially worth billions. The approval has sparked optimism among investors, but concerns about the company’s valuation and the ability to convert paper wealth into cash remain.

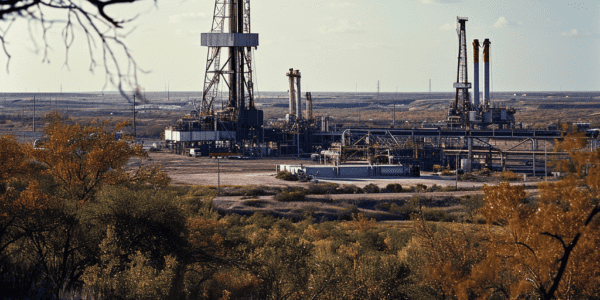

Southwestern Energy and Chesapeake Energy Merger

Southwestern Energy and Chesapeake Energy are on the verge of a merger that could create a company worth approximately $17 billion, positioning it as one of the largest natural-gas producers in the United States. Sources familiar with the situation have…