Study Links Cognitive Aging to Financial Skills in Seniors

A recent study from Binghamton University highlights the impact of age-related cognitive changes on financial skills in older adults. Led by Associate Professor Ian M. McDonough, the research emphasizes the importance of memory and cognitive health in preserving financial independence among seniors, who are often targeted by financial scams. Published in the Archives of Gerontology and Geriatrics, the study identifies critical brain regions involved in mathematical processing and underscores the need for interventions to support financial decision-making in aging populations.

Canada Launches Loop Global Visa Card to Empower SMEs in Cross-Border Trade

BackLoop and EQ Bank have launched the Loop Global Visa Card, a groundbreaking multi-currency credit card designed for Canadian SMEs engaged in international trade. This innovative financial solution simplifies cross-border transactions, allowing businesses to manage expenses efficiently in multiple currencies, thereby enhancing operational efficiency and supporting growth in the global marketplace.

Investing in Gold IRAs: Top Providers and Market Insights for December 2024

Explore the top gold IRA providers for December 2024, including JM Bullion, recognized for its extensive product selection and user-friendly approach. With gold prices fluctuating, now is the ideal time to diversify your investment portfolio through gold IRAs. Learn about the benefits of investing in precious metals and strategies to maximize returns.

Venture Capital Giants Invest $7 Billion in Databricks’ Fundraising Round

Leading venture capital firms Kleiner Perkins, Founders Fund, and SoftBank are investing in Databricks’ $7 billion fundraising round, marking a pivotal moment for the AI and data analytics company. Founded by the creators of Apache Spark, Databricks aims to enhance its product offerings and expand market reach, solidifying its position in the competitive tech landscape.

Ryan Specialty Expands International Financial Lines to Drive Growth in Insurance Sector

Ryan Specialty is set for significant growth in the insurance sector by enhancing its international financial lines capabilities. This strategic expansion aims to strengthen retail operations and meet the evolving needs of clients, positioning the company to capture opportunities in a dynamic market. With a focus on specialized insurance solutions, Ryan Specialty is committed to adapting to industry trends and technological advancements, ultimately driving innovation and efficiency in the insurance landscape.

South Korea to Invest $10 Billion in Semiconductor Industry by 2025

South Korea is set to invest $10 billion in fiscal support for its semiconductor industry in 2025, aiming to strengthen its position amid rising international competition and potential policy shifts from the upcoming U.S. administration. This strategic initiative will enhance innovation, production capacities, and ensure the country’s competitiveness in the global semiconductor market.

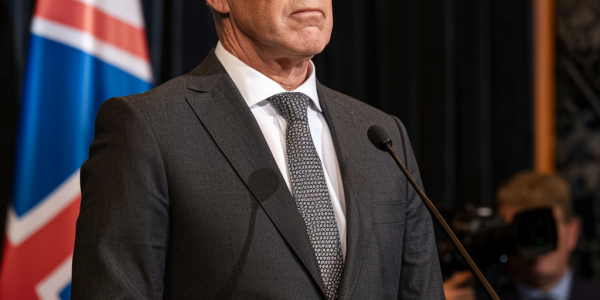

New Zealand PM Defends Economic Strategy Ahead of Key Fiscal Update

New Zealand Prime Minister Christopher Luxon defends his coalition government’s economic growth amid fiscal responsibility concerns. As the Treasury’s half-year fiscal update approaches, Luxon emphasizes commitment to achieving a budget surplus despite economic challenges. Finance Minister Nicola Willis signals a cautious approach, prioritizing prudent fiscal decisions over strict surplus targets. The upcoming update is expected to shape the government’s economic strategy as New Zealand navigates a complex financial landscape.

Gronkowski’s $69K Apple Investment Turns into $600K Success

NFL legend Rob Gronkowski shares how a $69,000 investment in Apple stock, inspired by his contractor’s advice, transformed into over $600,000. Gronkowski’s journey highlights the importance of seeking guidance and taking calculated risks in investing, showcasing how unexpected advice can lead to significant financial rewards.

AI Advancements Transforming Industries and Shaping the Future

Artificial intelligence is revolutionizing industries from healthcare to finance, enhancing efficiency and accuracy. AI tools improve diagnostic precision in healthcare, enable personalized medicine, and transform financial decision-making. With advancements in customer service, retail, and transportation, AI is reshaping our daily lives. However, ethical considerations and workforce adaptations are essential as we embrace this technological evolution.

Bitcoin Nears $100,000: A New Era for Cryptocurrency Investments

As Bitcoin approaches the $100,000 mark, investors are increasingly considering cryptocurrencies for their portfolios. This surge in Bitcoin’s value highlights its potential as a robust store of value, akin to gold. With growing institutional interest and a limited supply, Bitcoin is gaining traction among financial advisors and clients alike. Understanding the benefits and risks of cryptocurrency investments is crucial for navigating today’s evolving financial landscape.