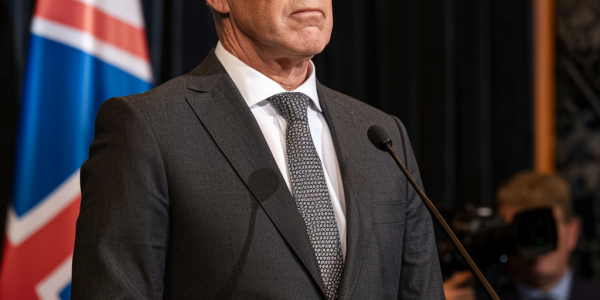

New Zealand PM Defends Economic Strategy Ahead of Key Fiscal Update

New Zealand Prime Minister Christopher Luxon defends his coalition government’s economic growth amid fiscal responsibility concerns. As the Treasury’s half-year fiscal update approaches, Luxon emphasizes commitment to achieving a budget surplus despite economic challenges. Finance Minister Nicola Willis signals a cautious approach, prioritizing prudent fiscal decisions over strict surplus targets. The upcoming update is expected to shape the government’s economic strategy as New Zealand navigates a complex financial landscape.

UK Economic Growth Revised Down Amid Rising Household Savings

Recent reports show a downward revision in the UK’s economic growth due to increased household savings, raising concerns about consumer behavior and its impact on the economy. Analysts warn that rising inflation and energy prices may lead to reduced spending, potentially hindering economic expansion. The Bank of England is monitoring these trends closely, as policymakers consider measures to stimulate consumer spending and support economic stability.

New Zealand Faces Economic Challenges with Declining GDP per Capita

New Zealand’s economy faces significant challenges, with a 0.6% decline in GDP per capita for Q2 2024, reflecting stagnation since before the COVID-19 pandemic. The current account deficit has surged to $30 billion, driven by weak export performance and rising interest rates. Policymakers must explore strategies to stimulate growth and enhance economic resilience amidst these troubling trends.

New Zealand’s Economy Shows Resilience Amidst GDP Decline

New Zealand’s economy shows signs of resilience despite a slight GDP decline of 0.2% in the June quarter of 2024. While the economy faces challenges like inflation and supply chain disruptions, growth sectors such as technology and renewable energy offer hope for recovery. The Reserve Bank of New Zealand is expected to maintain a gradual approach to easing monetary policy, aiming to support borrowing and spending. Despite current economic fluctuations, there are indications of stabilization in consumer confidence, suggesting a cautiously optimistic outlook for the future.

Economic Concerns Shape Voter Priorities in 2024 Presidential Race

As the 2024 presidential campaign intensifies, economic concerns dominate voter priorities, with polls showing a preference for Donald Trump over Kamala Harris on economic management. Despite a reported GDP growth of 3.0%, skepticism towards government statistics remains high, as many voters focus on their personal financial situations. The disconnect between official economic data and daily realities is shaping the electoral narrative, making economic issues a pivotal factor in the upcoming election.

U.S. Economy Grows 2.8% in Q2 2024, Exceeding Expectations

The U.S. economy showed impressive resilience with a 2.8% GDP growth in Q2 2024, surpassing expectations and driven by strong consumer spending and government expenditure. Despite challenges like rising imports and a declining personal savings rate, the positive economic indicators suggest a potential productivity boom and improved living standards. The Federal Reserve’s response to these developments will be crucial for future economic policy.

UK Economy Shows Signs of Improvement Amid Transition Period

The United Kingdom’s economy is on the path to recovery with improving consumer spending, declining inflation, and potential interest rate cuts by the Bank of England. Business surveys show growth resurgence, while reduced corporate insolvencies signal optimism for business investments. Despite resilient inflationary pressures, the gradual moderation of inflation is expected to lead to monetary policy relaxation in the near future.

Market Volatility Continues Amid Interest Rate Concerns

After a challenging month of April, Jim Cramer analyzes the market decline attributed to concerns over interest rates. The Federal Reserve’s rate decisions and strong economic data have investors on edge, hoping for reassurance from Fed Chair Jerome Powell. With uncertainty lingering, Cramer’s insights shed light on market conditions and factors influencing investor sentiment.

China’s Trade Surplus Raises Concerns in Global Economy

China’s trade surplus exceeding £800 billion annually raises concerns about its disproportionate focus on exports compared to imports. Addressing this imbalance requires a shift towards increasing imports rather than restricting exports, creating a more equitable global trade environment. Finding a sustainable solution to China’s trade surplus is crucial for fostering economic stability and fairness worldwide.

Voters in Swing States Feel Positive About Personal Finances Despite Negative Sentiment Towards National Economy

Recent polling shows that while voters in swing states have a negative view of the national economy, they feel positive about their personal finances. This raises questions about individual perceptions of the economy. Despite positive economic indicators, there seems to be a disconnect between macroeconomic data and individual outlooks.