Augusta Employment Hits Historic High Despite Hurricane Helene

In the aftermath of Hurricane Helene, the Augusta area has demonstrated remarkable resilience with a record employment rate of 238,000, the highest since the late 1990s. Despite challenges, sectors like hospitality thrived, while others faced setbacks. Insights from economist Dr. Simon Medcalfe reveal the potential for recovery and economic growth in the region, highlighting the adaptability of the local workforce and the importance of community resilience.

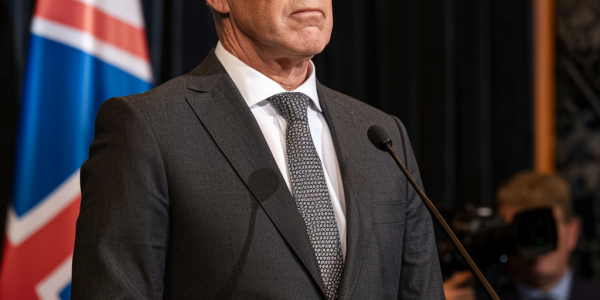

New Zealand PM Defends Economic Strategy Ahead of Key Fiscal Update

New Zealand Prime Minister Christopher Luxon defends his coalition government’s economic growth amid fiscal responsibility concerns. As the Treasury’s half-year fiscal update approaches, Luxon emphasizes commitment to achieving a budget surplus despite economic challenges. Finance Minister Nicola Willis signals a cautious approach, prioritizing prudent fiscal decisions over strict surplus targets. The upcoming update is expected to shape the government’s economic strategy as New Zealand navigates a complex financial landscape.

Study Highlights Menopause Challenges for Midlife Women in BC

A groundbreaking study by the Women’s Health Research Institute reveals significant health and economic challenges faced by midlife women in British Columbia, focusing on menopause. The HER-BC study highlights the impact of menopause symptoms on workplace performance, mental health, and the need for improved healthcare services, advocating for better support and policies for the 875,000 women aged 40 to 65 in the province.

Vietnam’s Economy Grows 7.4% Amid Typhoon Challenges

Vietnam’s economy showcases remarkable resilience with a 7.4% growth in Q3 2024, surpassing expectations despite challenges from Super Typhoon Yagi. The manufacturing and export sectors drive this growth, while the government aims for a GDP target of 6.8% to 7% amidst ongoing economic uncertainties. Analysts suggest potential interest rate cuts to stimulate activity, as Vietnam positions itself as a key player in global electronics production.

Economic Concerns Shape Voter Priorities in 2024 Presidential Race

As the 2024 presidential campaign intensifies, economic concerns dominate voter priorities, with polls showing a preference for Donald Trump over Kamala Harris on economic management. Despite a reported GDP growth of 3.0%, skepticism towards government statistics remains high, as many voters focus on their personal financial situations. The disconnect between official economic data and daily realities is shaping the electoral narrative, making economic issues a pivotal factor in the upcoming election.

Mixed Market Trends Amid Economic Indicators and Global Fluctuations

Market fluctuations dominated the finance landscape as US equity indices showed mixed results, with the Nasdaq 100 declining due to disappointing tech earnings, while the Russell 2000 thrived. Meanwhile, the ASX 200 ended its winning streak, reflecting struggles in the local tech sector. Positive economic indicators, including a rise in the US PMI and GDP growth, contrasted with a slowdown in the Euro Area. Investors remain cautious amid increased market volatility, with key economic reports set to influence future market directions.

Access Denied to Webpage Containing Chief Economist Information

Access to a webpage containing information related to chief economists and economics news has been denied, leaving users frustrated and unable to view the content. Efforts to resolve the issue and restore access are ongoing, with users advised to seek alternative sources of information in the meantime.

Weekend Sports Events in Baltimore Region Expected to Bring Economic Boost

Upcoming sports events in Baltimore, including the Preakness Stakes and Orioles games, are expected to bring a significant economic boost. Anirban Basu estimates the Preakness alone could generate $50 million in economic activity, while Orioles games could contribute $3-4 million. These events not only create job opportunities and tax revenue but also add vibrancy to the community, enhancing the overall appeal of the local area.

US Businesses More Optimistic Than Consumers, Poll Finds

Recent findings from the Milken Institute and Harris Poll show a significant gap in economic optimism between US business leaders and consumers. While over 80% of business leaders view the economy positively, only 40% of consumers share the same sentiment. The survey also highlights concerns about AI’s impact on employment and the need for inclusive economic growth strategies.

Anticipation Grows for Busy Financial Markets Week

The upcoming week of April 29, 2024, is anticipated to be bustling for the financial markets with earnings reports, Federal Reserve activities, data releases, and a Treasury Quarterly Refunding announcement. Speculation surrounds the potential impact of the Quarterly Refunding Announcement, with social media suggesting a liquidity injection into the markets. The Federal Reserve meeting is expected to impact credit spreads, with analysts noting potential tightening if rate cuts are rescinded by June.