Atlassian Stock Plummets Following Q3 Results

Atlassian’s stock price dropped by 9.56% after the release of its fiscal Q3 results, despite strong revenue growth. Analysts express concerns about future revenue potential as the company shifts focus to cloud services. Co-founder Scott Farquhar’s decision to step down as co-CEO raises unease among investors, but operational stability is expected to be maintained. With uncertainties surrounding its cloud growth, Atlassian remains optimistic about its long-term prospects amidst market volatility.

Investors Anticipate Earnings Reports from Key Companies

Investors are gearing up for a flurry of earnings reports from 12 portfolio companies this week, with chipmakers like Nvidia expected to take the spotlight. Microsoft’s bullish outlook on the PC market has also caught the attention of investors, sparking interest in an electronics retailer. Market watchers are eager to glean valuable insights that could impact investment decisions in the coming days.

U.S. Silica Holdings Inc. Reports First-Quarter Earnings of $13.7 Million

U.S. Silica Holdings Inc. reports a net income of $13.7 million in the first quarter, with revenue at $325.9 million. Stay informed with the latest business news, including updates on Starbucks, Snap stock, and self-driving cars. Subscribe to our free newsletters and podcasts for more insights into technology, innovation, and leadership trends.

Big Tech’s AI Investment: Will it Pay Off?

Big Tech companies like Google, Amazon, Facebook, and Apple are investing heavily in AI technologies to improve their products and services. While AI has the potential to revolutionize industries and streamline processes, there is still skepticism about its financial benefits. Despite challenges such as data privacy and regulatory scrutiny, these companies believe that AI will drive growth and innovation, leading to increased revenue and market dominance.

Tech Earnings Impact US Stock Indices Amidst Middle East Tensions

Today’s focus in the markets has shifted back to earnings as traders turn their attention away from geopolitical tensions in the Middle East. With concerns in that region easing, investors are now closely watching how tech earnings will impact US stock indices, particularly the Nasdaq, which recently saw a significant drop of over 5.5%, the largest in over 5 months. Stocks like Nvidia and Tesla, which previously drove the market to all-time highs, have experienced a decline of over 14% as investors took advantage of the Middle East situation to secure profits.

Dow Inc. Reports Mixed Financial Performance in Q1 2024

Dow Inc. reports mixed financial performance in Q1 2024 with lower sales but higher profits. Despite sales decline, the company demonstrates resilience and strategic management, maintaining profitability. Analysts watch closely for insights on market trends and economic outlook, highlighting Dow Inc.’s role as a key player in the plastics industry.

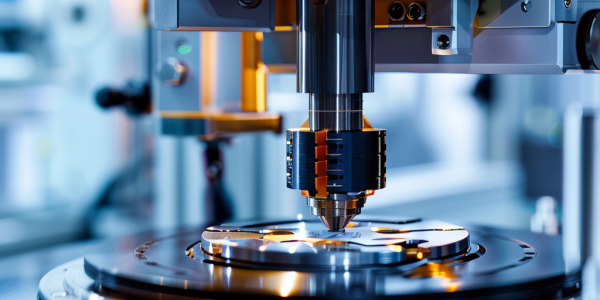

Lam Research Returns to Earnings Growth, Beats Expectations

Semiconductor equipment supplier Lam Research (LRCX) has returned to earnings growth, surpassing expectations for its fiscal third quarter. Despite declining sales, the company reported an 11% increase in earnings compared to the previous year. Lam Research CEO Tim Archer expressed optimism about the company’s performance, highlighting its strong start in calendar 2024. Stay updated on tech industry news and stock updates by following Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz.

ServiceNow Inc Reports Impressive Financial Results for Q1 2024

ServiceNow Inc (NOW) has reported impressive financial results for the first quarter of 2024, surpassing analyst revenue forecasts and demonstrating strong growth in various key metrics. With subscription revenue reaching $2,523 million, total revenue at $2,603 million, and net income of $347 million, ServiceNow’s performance highlights its position as a leader in digital workflow solutions. Strategic expansions and investments in AI technology have further solidified its market position, driving innovation across sectors like IT, customer service, HR, and security operations.

Ford’s First-Quarter Earnings for 2024 Show Successes and Challenges in EV Market

Ford’s first-quarter earnings for 2024 have been making headlines, with the company experiencing a mix of successes and challenges in the electric vehicle (EV) market. Despite beating analyst expectations overall, Ford faced an 84% decline in EV revenue in Q1 2024. One of the key highlights for Ford was the significant increase in EV sales, with the F-150 Lightning emerging as the top-selling electric pickup in the US and the Mustang Mach-E securing its position as the second best-selling electric SUV. However, Ford announced delays in EV production at its BlueOval City facility, pushing the timeline to 2026.

Chipotle Exceeds Market Expectations with Strong Quarterly Earnings Report

Chipotle Mexican Grill has exceeded market expectations with strong earnings, revenue, and same-store sales growth in its latest quarterly report. Despite challenges, such as higher prices and changing consumer behavior, the company saw a 5.4% increase in restaurant traffic and implemented a 50-for-1 stock split. With adjusted earnings per share of $13.37 and revenue of $2.7 billion, Chipotle outperformed analyst projections. CEO Brian Niccol highlighted the company’s success in attracting customers across income groups and balancing pricing strategies with customer satisfaction initiatives.