Berkshire Hathaway’s Elevated P/B Ratio Sparks Investor Scrutiny Ahead of Earnings Report

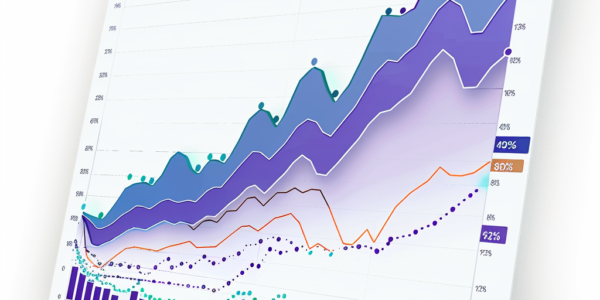

Berkshire Hathaway is under investor scrutiny as it approaches its second-quarter earnings report, with a notable price-to-book (P/B) ratio of around 1.6x. This elevated ratio raises questions about the company’s valuation and future growth potential. Analysts are closely monitoring performance indicators, management strategies, and market dynamics that could impact Berkshire’s stock performance amid rising interest rates and inflation. As the earnings date nears, understanding the implications of this P/B ratio is crucial for investors looking to navigate the complexities of the current economic landscape.

Aptar Reports Strong Start to the Year with Impressive Q1 Results

Aptar (ATR) reported a 5% growth in core sales and a significant 30% increase in adjusted EPS to $1.26 in the first quarter. The Pharma segment showed strong performance, while the Beauty segment maintained stable sales. Aptar anticipates Q2 adjusted EPS to range from $1.30 to $1.38 and is focused on enhancing shareholder value through strategic investments and cost management.

GDI Integrated Facility Services Reports 6% Increase in Revenue for Q4 2023

GDI Integrated Facility Services (GDI IFS) reported a 6% increase in revenue to $622 million for Q4 of fiscal 2023, with a 12% increase for the year. CEO Claude Bigras is confident in the company’s performance and growth prospects for 2024. The Business Service USA segment experienced a notable 10% organic growth and a 14% increase in adjusted EBITDA, while the Technical Service segment saw a decline in organic growth. GDI IFS aims to capture major clients in the US and reduce working capital by $50-60 million by the end of 2024, with a focus on organic growth and acquisitions.

Teladoc (NYSE:TDOC) Misses Q4 Sales Targets, Stock Drops 13.2%

Teladoc Health (NYSE:TDOC) disappoints in Q4 FY2023 with 3.6% revenue growth, falling short of analyst estimates. The stock drops 13.2% as next quarter’s revenue guidance also misses expectations. With a market capitalization of $3.48 billion, the telemedicine platform faces questions about its future sales growth.

The Trade Desk: Can It Maintain Its Stellar Performance in 2024?

The Trade Desk (TTD) has been a standout success in the stock market, delivering an impressive 379% return over the last five years. As investors look to 2024, the question arises: can the company maintain its stellar performance? The Trade Desk is a tech company that helps advertisers optimize their advertising budget and maximize returns. With a market worth close to $1 trillion in annual revenues, The Trade Desk operates in a lucrative industry. However, despite its strong track record, the stock is currently priced for perfection, presenting a potential risk for investors.

HubSpot Surpasses Q4 Earnings Expectations and Provides Strong Guidance

HubSpot (NYSE: HUBS) has released its Q4 earnings report, surpassing analysts’ expectations and providing a strong guidance for the upcoming year. The company reported Q4 EPS of $1.83, exceeding the analyst estimate of $1.54. Additionally, the revenue for the quarter stood at $581.9 million, surpassing the consensus estimate of $558.46 million. HubSpot’s positive performance and optimistic guidance have garnered attention from investors and analysts, indicating a promising outlook for the company. The news has led to a surge in the company’s stock, with shares experiencing a notable increase in value. These developments underscore HubSpot’s strong position in the market and its ability to deliver robust financial results.

Occidental Petroleum Corp Reports Strong Fourth Quarter for 2023

Occidental Petroleum Corp (OXY) has reported a strong fourth quarter for 2023, with key financial highlights reflecting operational performance and strategic growth. The company achieved a net income of $1.0 billion, or $1.08 per diluted share, and an adjusted net income of $710 million, or $0.74 per diluted share. Production exceeded guidance with 1,234 Mboed, and OxyChem Performance saw pre-tax income of $250 million, surpassing expectations. The quarterly dividend was raised by 22% to $0.22 per share, and strategic acquisitions, including the CrownRock acquisition and the Carbon Engineering acquisition, have enhanced the company’s onshore portfolio and supported low-carbon initiatives. Occidental’s proved reserves grew to 4.0 billion BOE with a reserves replacement of 137%. Operational excellence was a key driver of Occidental’s financial success, with operating cash flow reaching $3.2 billion and cash flow from operations before working capital at $2.5 billion. Despite challenges such as lower domestic crude oil prices and higher lease operating expenses, the company’s worldwide production exceeded expectations, demonstrating operational resilience and a strategic asset base. The oil and gas segment reported a pre-tax income of $1.6 billion for the quarter. Occidental’s strategic growth was underscored by the acquisition of CrownRock, which enhances its U.S. onshore portfolio with premier Permian Basin assets, and the acquisition of Carbon Engineering, supporting low-carbon initiatives. These moves are significant for the company’s long-term growth and shareholder value.

Lyft’s Rollercoaster Ride in the Stock Market

Lyft experienced a rollercoaster ride in the stock market as its shares surged and then plummeted after a major earnings release error was corrected by the CFO. Despite the setback, Lyft reported positive performance indicators, including adjusted earnings per share of 18 cents, surpassing the estimated 8 cents, and a revenue of $1.22 billion, in line with analyst expectations. CEO David Risher highlighted the company’s achievement of reaching a record number of annual riders, reflecting the volatility and challenges faced by companies in the ever-evolving ridesharing industry.

Lattice Semiconductor Reports Disappointing Q4 FY2023 Performance

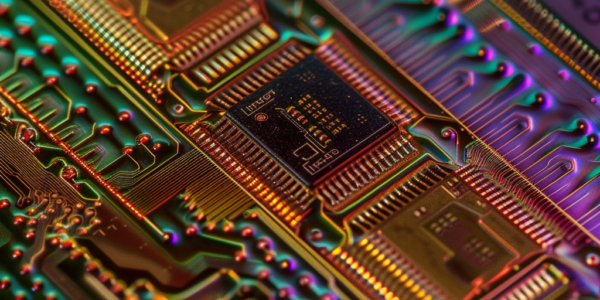

Lattice Semiconductor (NASDAQ:LSCC) reported a disappointing Q4 FY2023 performance, with a 3% year-on-year revenue decline and a decrease in non-GAAP profit. Despite these challenges, the company’s president and CEO highlighted double-digit annual revenue growth and a strong position for the long-term, supported by a rapidly expanding product portfolio and robust customer momentum. Lattice Semiconductor specializes in customer-programmable chips for tasks such as machine learning and operates in a market driven by significant demand for processors and graphics chips, particularly related to AI and machine learning.

AMD Reports Better-Than-Expected Q4 Financial Results

AMD, a leading chipmaker, has reported better-than-expected financial results for the fourth quarter, with an earnings per share (EPS) of $0.77, matching analyst estimates. The company’s revenue stood at $6.2 billion, surpassing the consensus estimate of $6.13 billion. As a…