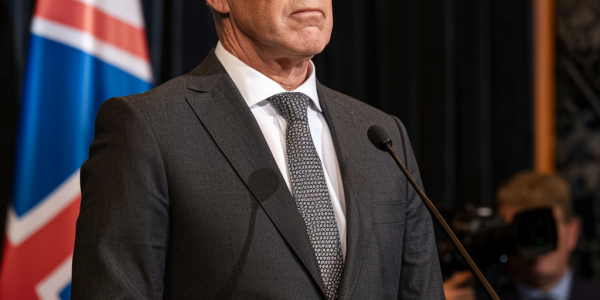

New Zealand PM Defends Economic Strategy Ahead of Key Fiscal Update

New Zealand Prime Minister Christopher Luxon defends his coalition government’s economic growth amid fiscal responsibility concerns. As the Treasury’s half-year fiscal update approaches, Luxon emphasizes commitment to achieving a budget surplus despite economic challenges. Finance Minister Nicola Willis signals a cautious approach, prioritizing prudent fiscal decisions over strict surplus targets. The upcoming update is expected to shape the government’s economic strategy as New Zealand navigates a complex financial landscape.

ECB Optimistic on Inflation Target Amid Economic Growth Concerns

The European Central Bank (ECB) remains optimistic about aligning inflation with its 2% target by next year, despite concerns over fragile economic growth. Vice President Luis de Guindos highlighted the dual challenges of improving inflation rates while addressing sluggish consumer spending. As the ECB prepares for future policy decisions, understanding the balance between inflation management and economic stimulation will be crucial for the Eurozone’s recovery.

Philippines Launches Enhanced Peso Interest Rate Swap Market

The Bankers Association of the Philippines has launched an enhanced Peso Interest Rate Swap (Peso IRS) market, utilizing the Philippine Overnight Reference Rate. This initiative aims to develop yield curves and improve liquidity in the domestic bond market, with participation from major banks and a trading platform by Bloomberg. BSP Governor Eli Remolona highlights its significance in boosting transactions and creating benchmark yield curves, marking a pivotal step in strengthening the Philippines’ financial landscape.

Contrasting Monetary Policies of RBA and RBNZ

Discover how the Reserve Bank of New Zealand’s possible interest rate cuts contrast with the Reserve Bank of Australia’s expectations of a rate hike, impacting their respective economies. Learn how the RBA’s cautious approach to inflation differs from the RBNZ’s swift actions, and how potential rate hikes in Australia could affect consumer spending. Gain insights into the diverging housing markets in Australia and New Zealand, and the implications of monetary policy decisions on economic outcomes.

Federal Reserve Chair Powell Highlights Ongoing Risks in Commercial Real Estate Sector

Federal Reserve Chair Jerome Powell emphasizes the ongoing risks in the commercial real estate sector that banks are facing, highlighting the importance of accurate risk assessment and management. Powell stresses the need for banks to have sufficient capital, liquidity, and robust systems in place to navigate the complexities of this risk. While major financial institutions are well-equipped to handle the commercial real estate risk, smaller banks with significant local concentrations may face greater challenges. Supervisors and regulators are closely monitoring these banks to ensure effective risk mitigation measures are in place. Powell reassures that efforts are underway to address and navigate through this challenge, emphasizing proactive risk management strategies.

ECB Officials Face Political Turmoil in France at Annual Retreat

European Central Bank officials at the Sintra Forum are grappling with political turmoil in France following snap elections. Concerns over France’s fiscal path and potential market stabilization moves by the ECB are at the forefront. The outcome of the elections could impact borrowing costs and the bond yield spread between French and German government bonds, posing challenges for the ECB.

BIS Warns Central Banks to Exercise Caution with Interest Rate Cuts

The Bank for International Settlements (BIS) has warned central banks to be cautious when considering interest rate cuts, emphasizing the need for prudence and careful evaluation. With global economic challenges looming, central banks are advised to set a ‘high bar’ for implementing such measures to safeguard against risks and maintain stability.

Federal Reserve Bank of Minneapolis President Neel Kashkari Addresses Possibility of Interest-Rate Increases

Federal Reserve Bank of Minneapolis President Neel Kashkari addresses the possibility of interest-rate increases, emphasizing the need for more evidence of cooling inflation before considering rate cuts. Despite acknowledging the current restrictive policy stance, Kashkari stresses the importance of assessing demand impact before making new policy decisions. The Federal Open Market Committee is expected to maintain interest rates at a 23-year high during their upcoming meeting in June. Kashkari warns of risks in the commercial property market and anticipates surprises in the distribution of potential losses.

Challenges and Solutions for Federal Reserve’s Forecasting Methods

The Federal Reserve is reevaluating its forecasting methods in light of economic surprises, with scenario analysis emerging as a promising alternative. By exploring a spectrum of risks and potential responses, central banks can enhance transparency and better prepare stakeholders for future policy actions amidst evolving economic dynamics.

Household Responses to High Inflation: Consumption, Saving, and Income Strategies

Households have faced significant challenges due to high inflation triggered by supply bottlenecks and energy price surges. According to the ECB’s Consumer Expectations Survey, consumers have adjusted their consumption, savings, and income strategies in response to elevated prices. The data indicates that consumers have resorted to measures such as shopping around, trading down to lower quality products, and reducing quantities purchased. The findings shed light on how households have adapted their spending and saving behavior in the face of high inflation, providing valuable insights into consumer resilience and adaptation during challenging economic conditions.