Stock Yards Bank & Trust Co. increases position in Alphabet Inc. by 4.2% in first quarter

Stock Yards Bank & Trust Co. increases position in Alphabet Inc. by 4.2% in first quarter, now holding 535,521 shares valued at $80,826,000. Other notable investors like Vanguard Group Inc., Norges Bank, Fisher Asset Management LLC, and Charles Schwab Investment Management Inc. also made moves with Alphabet stock.

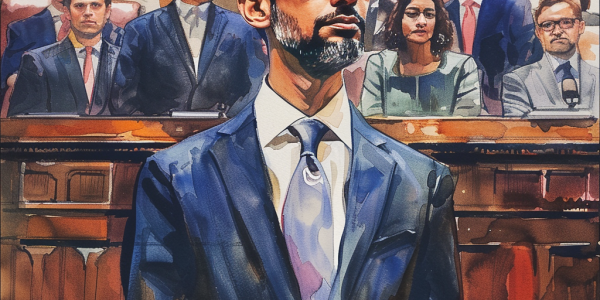

Google CEO and Co-Founder Ordered to Undergo Questioning in Antitrust Lawsuit

U.S. District Judge Sean Jordan has ruled that Google CEO Sundar Pichai and co-founder Sergey Brin must undergo questioning in an antitrust lawsuit filed by Texas and other states against Alphabet Inc. The lawsuit alleges monopolistic practices in the digital advertising market, with the judge’s decision mandating the depositions. Google has denied all allegations, with the depositions set to explore key topics like Google’s acquisition of DoubleClick and a significant advertising deal with Facebook.

Waymo Opens Robotaxi Service to All San Francisco Residents

Waymo, the autonomous vehicle company, has opened up its robotaxi service to all residents of San Francisco, ditching the waitlist process. This move aims to solidify Waymo’s position in the industry and increase confidence in its technology, despite recent challenges faced by competitors. By normalizing autonomous vehicles, Waymo is paving the way for a profitable operation and contributing to the evolution of the industry.

Google and Microsoft Focusing on India for AI Development

Google CEO Sundar Pichai highlights India’s significant role in shaping the future of Artificial Intelligence (AI) during Google I/O 2024, emphasizing the country’s potential to influence global AI development. Pichai notes India’s rapid adoption of mobile technology and strong interest in AI tools, with Google committed to providing advanced AI tools to the Indian market. He underscores Google’s research leadership in AI technology and cutting-edge infrastructure tailored for the AI era.

Google’s Rally Still Has Legs – Double-Digit Growth Ahead

Google, a subsidiary of Alphabet Inc., impresses investors with its strong performance and growth prospects. Analysts project Google Cloud alone reaching a revenue run-rate of $100 billion by 2024. Despite competition, Google’s focus on AI technologies drives innovation and market expansion, leading to sustained double-digit growth expectations.

Stock Market Today: Dow slumps 570 points to end worst month since September 2022 as Fed decision looms

Stock Market Today: Dow slumps 570 points to end worst month since September 2022 as Fed decision looms. April saw mixed performances among the Magnificent Seven companies, with Meta Platforms Inc. facing a double-digit drop and Alphabet Inc. rallying. Tesla Inc. made gains, while Nvidia Corp. experienced a retreat. Amazon.com Inc. is expected to finish the month with a modest decrease, showcasing the ongoing dynamics in the stock market.

Big Tech’s AI Investment: Will it Pay Off?

Big Tech companies like Google, Amazon, Facebook, and Apple are investing heavily in AI technologies to improve their products and services. While AI has the potential to revolutionize industries and streamline processes, there is still skepticism about its financial benefits. Despite challenges such as data privacy and regulatory scrutiny, these companies believe that AI will drive growth and innovation, leading to increased revenue and market dominance.

Alphabet Inc. Considers Dividend Payments Following Cash Influx

Alphabet Inc. may consider initiating dividend payments following a cash influx, with analysts predicting a potential $70 billion allocation for share buybacks. Experts believe introducing a dividend could boost stock performance, as seen with Meta Platforms Inc. Andrew Zamfotis from Ami Asset Management Corp. highlights the value of cost discipline through dividend initiation. Despite traditionally being associated with mature firms, the trend of tech companies introducing dividends is growing. With a focus on generative AI strategies, Alphabet’s stock has outperformed Microsoft Corp. and the Nasdaq 100 this year. Projections show Alphabet’s free cash flow could reach $83 billion by 2024, with over $110 billion in cash and equivalents as of 2023. Tejas Dessai from Global X ETFs suggests Alphabet may introduce dividends this year.

Alphabet’s Strong Performance in Stock Market Reflects Growth Potential

Alphabet, the parent company of Google, has shown remarkable performance in the stock market over the past five years, outperforming the Nasdaq Composite Index. Investing in strong businesses and holding onto them can lead to significant returns, and Alphabet continues to be a smart stock choice based on its current valuation. With a market capitalization of $1.978 billion and a strong growth track record, Alphabet remains a standout performer offering substantial returns to long-term investors. Its impressive compound annual growth rates in revenue and earnings per share, along with a reasonable forward price-to-earnings ratio, position Alphabet as an attractive investment option for those seeking long-term growth opportunities.

Alphabet Considering Offer to Acquire HubSpot, Leading to Surge in Shares

Alphabet, the parent company of Google, is reportedly considering making an offer to acquire HubSpot, a marketing software company, leading to a 7% surge in HubSpot’s shares on Thursday afternoon. The potential acquisition of HubSpot by Alphabet could mark a significant move for the tech giant, but it is important to note that no formal offer has been made yet. Both Alphabet and HubSpot have refrained from providing immediate comments on the matter.