In a recent study conducted by researchers at Binghamton University, significant insights have emerged regarding how age-related changes in the brain can impact financial skills among older adults. This research, led by Associate Professor of Psychology Ian M. McDonough, aims to understand the cognitive mechanisms that could help preserve the financial independence of seniors, who are often targeted by various financial scams.

Financial scams, ranging from phishing emails to deceptive phone calls, pose a serious threat to senior citizens. As they age, many individuals face cognitive declines that can affect their ability to manage finances effectively. The study, co-authored by Macarena Suárez-Pellicioni from the University of Alabama, was published in the Archives of Gerontology and Geriatrics and highlights the importance of understanding how cognitive changes relate to financial management.

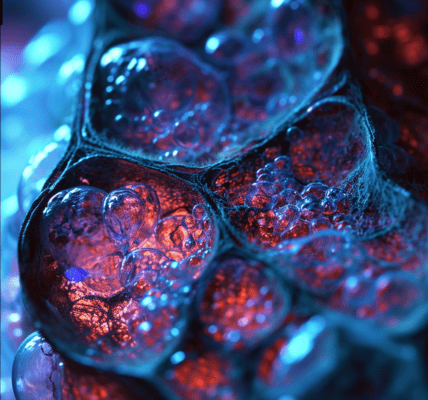

The research focused on cognitively healthy adults aged 50 to 74 years. Using MRI scans, the study measured both brain structure and functional connectivity while participants engaged in simple financial tasks, such as balancing a checkbook or making change. These tasks require a combination of cognitive skills, including memory, executive functioning, and numerical ability. Aging can lead to subtle declines in these areas, which may hinder financial decision-making.

Previous studies on financial management, particularly in the context of Alzheimer’s disease, primarily concentrated on the parietal cortex, a brain region associated with attention and the ability to simulate future outcomes. However, McDonough’s research shifts the focus to regions specifically involved in mathematical processing, an area that has received less attention in adult populations.

The study identifies two key brain regions involved in mathematics: the inferior frontal gyrus and the middle frontal gyrus. The inferior frontal gyrus is essential for retrieving mathematical information from memory. For instance, when asked, ‘What’s 3 plus 3?’, individuals can quickly respond with ‘6’ without needing to perform any calculations. This rapid recall is a result of years of rote learning, which embeds these answers in memory.

In contrast, when individuals do not have an immediate answer memorized and need to perform calculations, the middle frontal gyrus becomes active. This region requires more cognitive effort, which can increase the likelihood of errors. McDonough explains, “When people are doing the calculation, they’re more likely to get it wrong. If you’ve memorized it, you’ve memorized the right answer. You’re faster, more efficient, and more accurate when you have those verbal representations.” This distinction is crucial, as it highlights the importance of memory in financial tasks.

As part of the normal aging process, the prefrontal cortex, which is vital for decision-making and impulse control, tends to shrink. This shrinkage is accelerated in individuals with Alzheimer’s disease, leading to a greater likelihood of financial miscalculations. The implications of these findings are significant, as they suggest that maintaining cognitive health is essential for preserving financial skills in older adults.

The study underscores the need for interventions that can help seniors retain their financial independence. By focusing on enhancing memory and cognitive functions related to financial management, it may be possible to mitigate the risks associated with aging and financial decision-making. This research not only contributes to the understanding of cognitive aging but also emphasizes the importance of supporting older adults in navigating their financial lives.

In conclusion, as the population ages, understanding the intersection between cognitive health and financial competency becomes increasingly important. This study paves the way for future research and potential interventions aimed at helping seniors maintain their financial independence and protect themselves from scams that exploit their vulnerabilities.