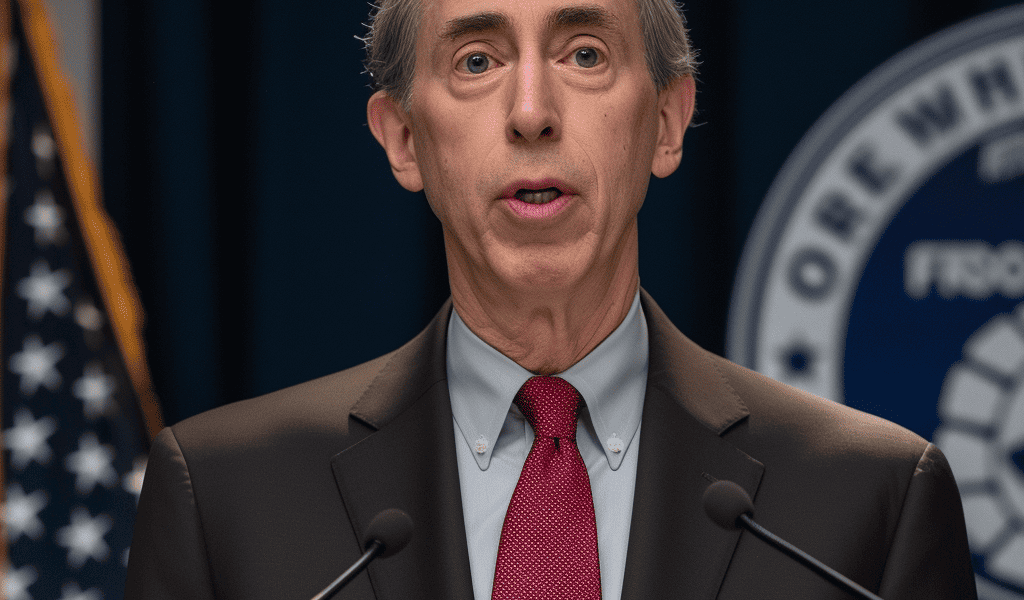

The Securities and Exchange Commission (SEC) has recently implemented comprehensive rules and amendments to strengthen investor protections within Special Purpose Acquisition Companies (SPACs) and their subsequent business combination transactions, commonly known as de-SPAC transactions. SPACs have gained significant traction as an alternative method for private companies to enter the public markets. In light of the challenges involved in these transactions, the SEC’s Chair, Gary Gensler, has emphasized how crucial it is to adopt SPAC’s rules similar to those for traditional Initial Public Offerings (IPOs).

These measures focus on the requirements for adequate disclosures, responsible use of projections, and heightened obligations for issuers.

Aligning SPAC Disclosures with IPO Standards

The SEC’s latest rules address concerns surrounding SPAC IPOs and de-SPAC transactions by mandating adequate disclosures. The watchdog has emphasized critical areas such as conflicts of interest, SPAC sponsor compensation, dilution, and other essential information vital for investors navigating the complexities of SPAC offerings.

Record Year for Spectrum with 1.62 Billion Securities Traded

Gensler mentioned: “Today’s adoption will help ensure that the rules for SPACs are substantially aligned with those of traditional IPOs, enhancing investor protection through three areas: disclosure, use of projections, and issuer obligations.”

“Taken together, these steps will help protect investors by addressing information asymmetries, misleading information, and conflicts of interest in SPAC and de-SPAC transactions.”

Regulators

Which are the regulators out there for trading?

FSA

ASIC

Find more

Projection Disclosure Requirements

The SEC’s rules also clarify the realm of projections in de-SPAC transactions. Target companies must disclose all material bases and assumptions underlying projections, offering a more transparent view for investors to make informed decisions.