First Detection of Highly Pathogenic Avian Influenza in Livestock in the United States

The Minnesota Board of Animal Health (MBAH) has reported the first detection of highly pathogenic avian influenza (HPAI) in livestock in the United States. The virus was found in a baby goat on a farm where an outbreak had recently been identified in poultry, marking the first instance of HPAI in livestock in the country. The detection raises concerns about the potential impact on animal health and the need for enhanced surveillance and biosecurity measures to prevent further spread of the virus.

Wisconsin Badgers Secure Spot in Frozen Four with Dominant Victory

The No. 2 Wisconsin Badgers secure their spot in the Frozen Four with a dominant 4-0 victory over No. 7 St. Lawrence. Senior Casey O’Brien nets the game-winning goal just 16 seconds into the match, while sophomore Laila Edwards adds two quick goals. Goalie Ava McNaughton delivers a stellar performance with 25 saves and her fifth shutout victory of the year. Wisconsin ultimately takes control in the latter stages of the game, securing their place in the Frozen Four.

Potential First-Round Upset Candidates in NCAA Men’s Tournament

The NCAA men’s tournament is just around the corner, and with it comes the excitement of potential upsets and Cinderella stories. As the tournament kicks off, fans and analysts alike are on the lookout for those unexpected victories that can shake up the brackets and defy the odds. Let’s take a look at some potential first-round upset candidates in the men’s tourney field seeded 11th or lower, including matchups like Samford vs. Kansas, James Madison vs. Wisconsin, Wright State vs. Tennessee, Michigan State vs. Miami, and Notre Dame vs. Alabama.

Australia gears up to host Lebanon in FIFA World Cup 2026™ Qualifying campaign

The FIFA World Cup 2026™ Qualifying campaign resumes as the Subway Socceroos prepare to host Lebanon at CommBank Stadium in Sydney. Australia has had a strong start with two wins in Group I, while Lebanon secured draws against Palestine and Bangladesh. The match will be broadcast live and free on Network 10, with coverage starting on 10 Bold from 7:30 pm AEDT. Stay tuned for the latest updates and coverage of the FIFA World Cup 2026™ Qualifiers.

Recent Events and Data Privacy Concerns

Recent events have raised concerns about the use of personal data and the responsibility of companies and their partners in handling this information. France Médias Monde and its partners utilize cookies and similar technologies to access and store non-sensitive data, such as IP addresses, for purposes including enhancing user experience, monitoring audience metrics, providing social network features, and displaying personalized ads. By clicking ‘Accept’, users consent to the use of cookies and similar technologies. However, they also have the option to ‘Customize’ their preferences or manage privacy settings at any time. The company and its partners engage in data processing activities based on user consent, which include storing and/or accessing information on devices, delivering personalized ads and content, measuring ad and content performance, gaining audience insights, and developing products.

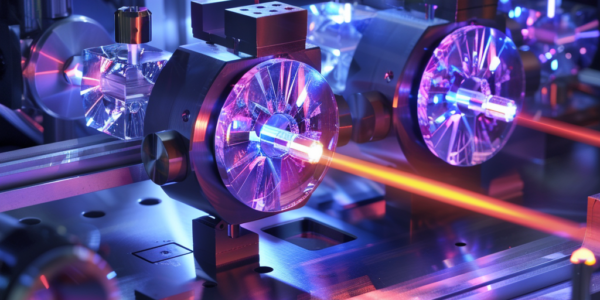

Caltech Researchers Develop Groundbreaking Quantum Imaging Technique

Caltech researchers have developed a groundbreaking new quantum imaging technique, ICE, which utilizes entangled photon pairs to overcome challenges in quantum imaging. This technique has the potential to revolutionize biomedical imaging and remote space sensing, offering higher-resolution images of biological materials and precise measurements of birefringent properties.

‘Toys for Boys’ Collection: A Rare Opportunity for Automotive Enthusiasts

The ‘Toys for Boys’ Collection, a unique set of six super exclusive Porsche cars and a truck, is now up for sale through a dealership in the United Kingdom, RPM Technik. The collection, never driven and in mint condition, was designed by Austrian architect Alexander Serda to recreate the wooden truck and cars he played with as a child. This one-of-a-kind collection offers a rare opportunity for enthusiasts to own a piece of automotive history and is a nostalgic tribute to childhood dreams turned into reality.

Tech Giants Accuse Apple of Non-Compliance in Epic Games Trial

Major tech companies like Meta and Microsoft are accusing Apple of non-compliance with a court order in its trial against Epic Games. The dispute centers around Apple’s App Store rules and its 15 to 30 percent fees on in-app purchases, sparking controversy among app developers. The involvement of other major developers underscores the far-reaching impact of Apple’s rules, demonstrating that even the largest tech companies are affected.

Riot Games Announces Major Reset for League of Legends MMO Development

Riot Games announces a major shift in the development of its highly anticipated League of Legends MMO, putting the game on hold for potentially several years. The decision to reset the development stems from the realization that the initial vision for the game wasn’t different enough from existing titles in the genre. This reflects Riot’s commitment to delivering a truly innovative and groundbreaking experience within the MMO genre, rather than simply offering a familiar MMO with a League of Legends theme.

Microsoft Revamps Xbox Rewards Program

Microsoft is revamping its Rewards program on Xbox to create a more streamlined and unified experience for users. The new Rewards hub will consolidate all Xbox-related activities and offers, with a focus on simplifying goal-setting, earning, and redeeming points. The company is also introducing new activities and tasks to enhance the gaming experience and is committed to ensuring a more consistent experience for players worldwide. Overall, the changes signal Microsoft’s dedication to providing greater value to its user base and a more rewarding Xbox Rewards program in the near future.