In the wake of the pandemic, the economic landscape in the United States has sparked a complex debate among experts and commentators. While many liberal-leaning analysts have celebrated the recovery as a model for the industrialized world, ordinary Americans have expressed a more nuanced view. The backdrop of global supply chain disruptions, particularly due to China’s extended COVID-19 lockdowns, and high inflation rates from mid-2021 through mid-2023 have contributed to widespread fears of a looming cost-of-living crisis.

Despite these concerns, the past year has shown a steady trend of disinflation, which has occurred without significantly hampering economic growth or employment rates. Recent data indicates that real wage growth has finally begun to outpace inflation, a welcome development after a prolonged period of stagnation. Many optimistic Democrats are now suggesting that a “soft landing” for the economy may be on the horizon, attributing this potential success to the Biden administration’s proactive fiscal measures, infrastructure investments, and industrial policies that have purportedly supported a more robust recovery than might have otherwise been achieved.

When examining the macroeconomic landscape, the situation appears relatively stable, especially when juxtaposed with the economic challenges faced by European nations such as Britain and Germany, or even when compared to America’s sluggish recovery from the Great Recession. However, beneath the surface, there are several indicators that suggest the recovery may be more fragile than it seems, hinting at potential downturns ahead.

One of the primary concerns is the prolonged high interest rates implemented to combat inflation. These rates have made it increasingly expensive for businesses to borrow funds for essential investments in upgrades, expansion, and hiring. For working families, the burden of repaying monthly credit card balances has also intensified. Moreover, these elevated interest rates have stifled the housing market, making it more challenging for middle-class Millennials to purchase homes and exacerbating the existing housing shortage. This situation has allowed high rents—one of the significant contributors to inflation—to persist without restraint.

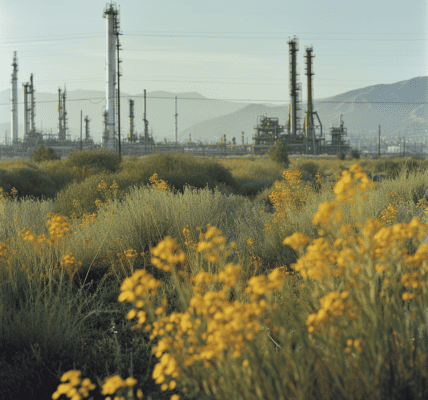

Perhaps the most alarming development is the looming threat of a recession in the domestic manufacturing sector. Recent reports indicate that manufacturing output has contracted for five consecutive months, a trend attributed to uncertainty surrounding interest rates and a severe shortage of skilled labor. This downturn is not solely a byproduct of Federal Reserve policies that reinforce supply-side constraints; it also highlights the ongoing struggles of the Biden administration to reshore industry effectively. The manufacturing sector has experienced sluggish growth since at least 2019, with data from the Institute for Supply Management revealing that the downturn from 2022 to 2023 marked the longest period of contraction since the early 2000s.

Several long-term structural issues contribute to this troubling trend. A vicious cycle of plant closures, regional underemployment, and a decline in both skills and consumer demand for domestic goods has emerged. Following decades of disinvestment, the implementation of higher tariffs and generous subsidies has not been sufficient to reverse the damage done to the manufacturing base.

As the economic narrative unfolds, the interplay between policy decisions, consumer sentiment, and global economic trends remains critical. The upcoming months will be pivotal as policymakers grapple with the challenges posed by high interest rates, housing shortages, and a manufacturing sector on the brink of recession. The path forward requires careful navigation to ensure that the recovery remains on track, while addressing the underlying issues that threaten its sustainability.

In summary, while the broader economic indicators may paint a picture of recovery, the reality for many Americans is one of uncertainty and concern. The effects of inflation, rising interest rates, and a struggling manufacturing sector are felt deeply, particularly among those who have yet to experience the benefits of any economic rebound. As experts analyze these dynamics, the need for effective policy interventions becomes increasingly urgent to foster a resilient economic environment that can withstand future challenges.