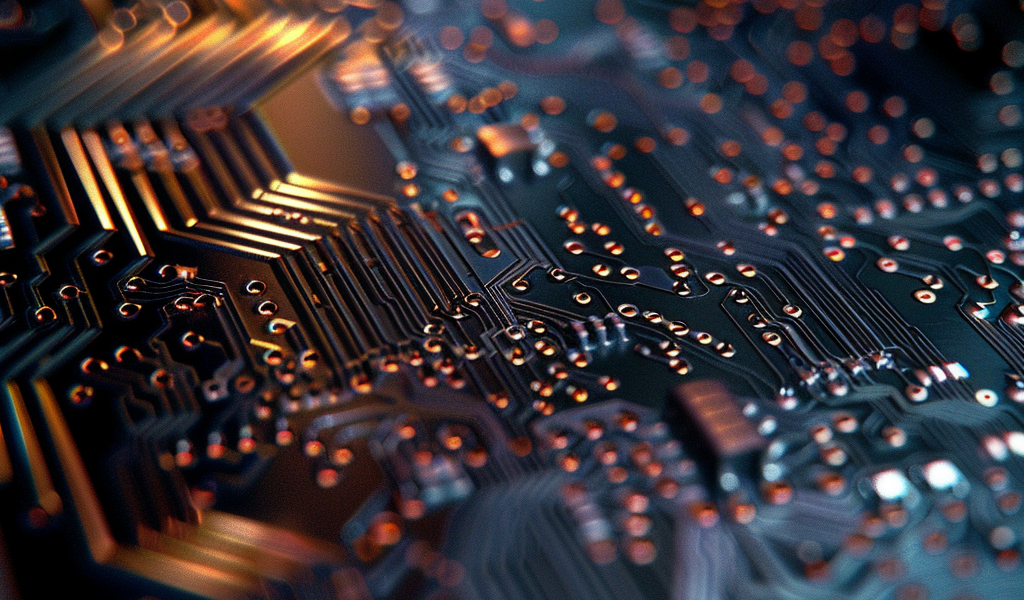

Breaking News: Mizuho raises its price targets for semiconductor stocks

Mizuho analysts have raised their price targets for Arm Holdings, NVIDIA, Broadcom, and AMD in a note to clients this week. The new price targets are $160 (from $100) per share for Arm Holdings, $1,000 (from $850) for NVIDIA, $1,550 (from $1,450) for Broadcom, and $235 (from $200) for AMD.

In their assessment, Mizuho highlighted the current AI and Custom Silicon landscape, emphasizing the significant upside opportunities for ARM despite an upcoming lockup expiration. They also pointed out that NVDA remains the biggest near-term AI winner, with AMD and AVGO also being major beneficiaries.

The firm sees an accelerating custom silicon roadmap, with Neoverse N3/V3 and foundry collaboration. They believe that strategic investors will continue to own ARM given its attractive long-term roadmap.

Following this news, the stock market experienced some reactions, with comments from investors expressing various opinions on Mizuho’s analysis.

It will be interesting to see how these price targets and assessments play out in the semiconductor market in the coming weeks.