More than two million Canadians are set to face the reality of higher interest rates as they renew their mortgages in the coming years. With millions of mortgage terms coming due for renewal in Canada, homeowners who have been benefiting from low-cost mortgages are in for a shock.

The Canada Mortgage and Housing Corporation (CMHC) reports that approximately 2.2 million mortgages are due for renewal in 2024 and 2025. Additionally, a report by Royal LePage released in October 2023 indicates that 3.4 million Canadians will have mortgages up for renewal by March 2025.

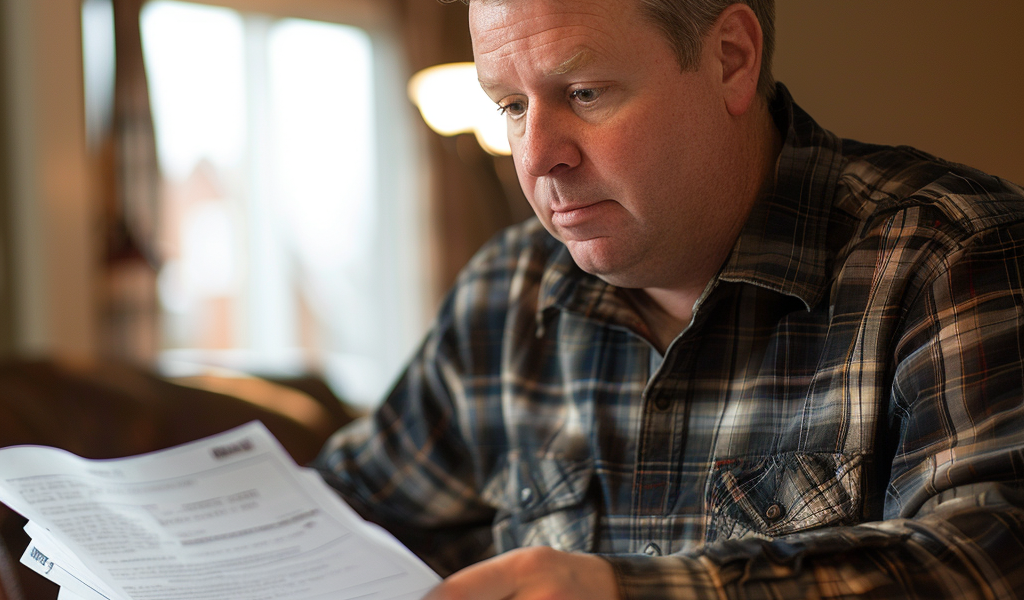

One such homeowner, Tom McCormick, a resident of Windsor and a real estate investor, recently experienced the unsettling realization that his interest rate is likely to double upon mortgage renewal. McCormick, who purchased his first home in 2020 and converted it into a duplex, is now facing the prospect of a significantly higher interest rate compared to the less than 2 per cent rate he initially secured.

As a result, McCormick anticipates that his monthly payment could increase by as much as $1,500, a cost that may ultimately be passed on to his tenants. Despite the financial burden, McCormick plans to raise rent by only a modest amount to cover additional expenses.

Over the past two years, the average monthly mortgage expenditure in Windsor has risen substantially. Data from CM indicates that the average monthly mortgage payment has surged from around $1,100 in early 2019 to over $1,800 in 2024. This increase aligns with the Bank of Canada’s key lending rate, which has climbed from 1 per cent in April 2022 to 5 per cent today.

Bekim Merdita, the executive vice president of Rocket Mortgage Canada, highlights the current wave of mortgage renewals as the ‘largest in Canadian history.’ Merdita emphasizes the importance of strategic planning for mortgage holders to navigate the changing landscape without succumbing to panic.