Dell’s stock saw a late surge following a record close for the Nasdaq, while cybersecurity firm Zscaler reported earnings that surpassed Wall Street expectations but fell on guidance licensing.

After the market closed, Zscaler revealed a 105% increase in earnings to 76 cents per share on an adjusted basis, with revenue climbing 35% to $525 million. Analysts had anticipated earnings of 58 cents per share on sales of $507.6 million. Additionally, billings rose 27% to $627.6 million, surpassing estimates of $610.5 million.

For the upcoming quarter ending in April, Zscaler projected earnings per share in the range of 64 to 65 cents, higher than the estimated 58 cents. The company also forecasted revenue of $535 million, exceeding analysts’ predictions of $532 million.

Despite the positive earnings, ZS stock plummeted over 6% to 225.30 in extended trading. Prior to the earnings release, the cybersecurity stock had experienced a 7% increase in 2024 and an 81% rise over the past year. Zscaler’s Relative Strength Rating was 94 out of 99, according to IBD Stock Checkup.

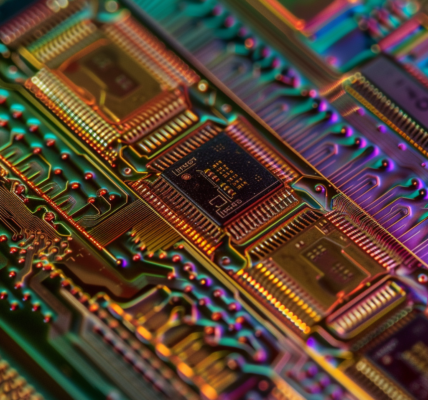

Zscaler, based in San Jose, California, offers cloud-based cybersecurity services through 150 data centers globally. Its web security gateways inspect customers’ data traffic for malware, while the Zscaler Private Access (ZPA) cloud service replaces virtual private networks to facilitate remote work. Zscaler competes with Palo Alto Networks and Microsoft.