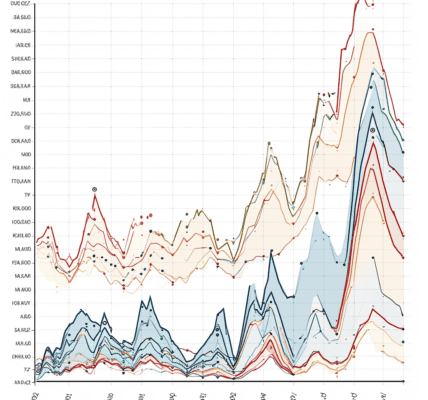

Johnson & Johnson (NYSE:JNJ) experienced a slight drop in its stock value despite reporting a strong fourth-quarter performance. The global healthcare giant saw a 7.3% year-over-year increase in revenue, reaching $21.4 billion, surpassing estimates by $380 million. Additionally, its earnings per share (EPS) of $2.29 exceeded expectations by $0.01.

For the full year, Johnson & Johnson achieved a 6.5% revenue growth, amounting to $81.16 billion, with net earnings rising by 6.8% to $25.41 billion. The company witnessed sales growth in the U.S. market, which surged by 11% to $12 billion in the fourth quarter, driven by its Innovative Medicine, MedTech, and Worldwide segments.

The growth in Innovative Medicines was attributed to products such as Darzalex, Erleada, Carvykti, Stelara, and Spavato. Furthermore, the acquisition of Abiomed contributed to gains in the MedTech segment. Looking ahead to Fiscal Year 2024, Johnson & Johnson anticipates revenue to range between $87.8 billion and $88.6 billion, with an expected EPS of $10.55 to $10.75.

Despite the positive performance, the stock’s rating remains at a Moderate Buy consensus, with the average price target of $178.08 suggesting a potential 9.6% upside. This comes after a nearly 4% increase in the company’s share price over the past month.