GE Announces Strong Fourth Quarter 2023 Results

January 23, 2024

General Electric (NYSE: GE) has reported its fourth-quarter results for 2023, showcasing a robust performance and setting the stage for the launch of GE Aerospace and GE Vernova as independent public companies in early April.

Key highlights from the fourth quarter of 2023 include:

- Total orders of $21.7B, marking an 8% increase, with organic orders up 7%

- Total revenues (GAAP) of $19.4B, reflecting a 15% growth; adjusted revenues* at $18.5B, up 13% organically*

- Profit margin (GAAP) of 10.3%, up by 90 bps; adjusted profit margin* at 9.6%, showing a 50 bps organic increase*

- Continuing EPS (GAAP) of $1.44, adjusted EPS* at $1.03

- Cash from Operating Activities (GAAP) at $3.2B, with free cash flow* at $3.0B

For the full year 2023, GE reported:

- Total orders of $79.2B, a substantial 25% increase, with organic orders also up by 25%

- Total revenues (GAAP) of $68.0B, showing a 17% growth; adjusted revenues* at $64.6B, up 17% organically*

- Profit margin (GAAP) of 15.0%, a significant increase of 1,640 bps; adjusted profit margin* at 8.8%, up by 310 bps organically*

- Continuing EPS (GAAP) of $7.98, adjusted EPS* at $2.81

- Cash from Operating Activities (GAAP) at $5.6B, with free cash flow* at $5.2B

GE Chairman and CEO, H. Lawrence Culp, Jr., expressed optimism for the upcoming year, emphasizing the impending launch of GE Aerospace and GE Vernova as independent entities. Culp highlighted the commitment to innovation and continuous improvement, with a focus on their respective industries and customer service.

Culp commended the teams for delivering an outstanding performance in 2023, noting the significant increase in earnings and free cash flow. GE Aerospace demonstrated solid revenue and operating profit growth in the fourth quarter, with double-digit revenue, profit, and cash growth for the year. Meanwhile, GE Vernova achieved meaningful improvements in Renewable Energy and Power, with double-digit revenue growth in the quarter and positive profit and free cash flow for the year. Culp expressed expectations for further growth in revenue, profit, and free cash flow for both GE Aerospace and GE Vernova in 2024.

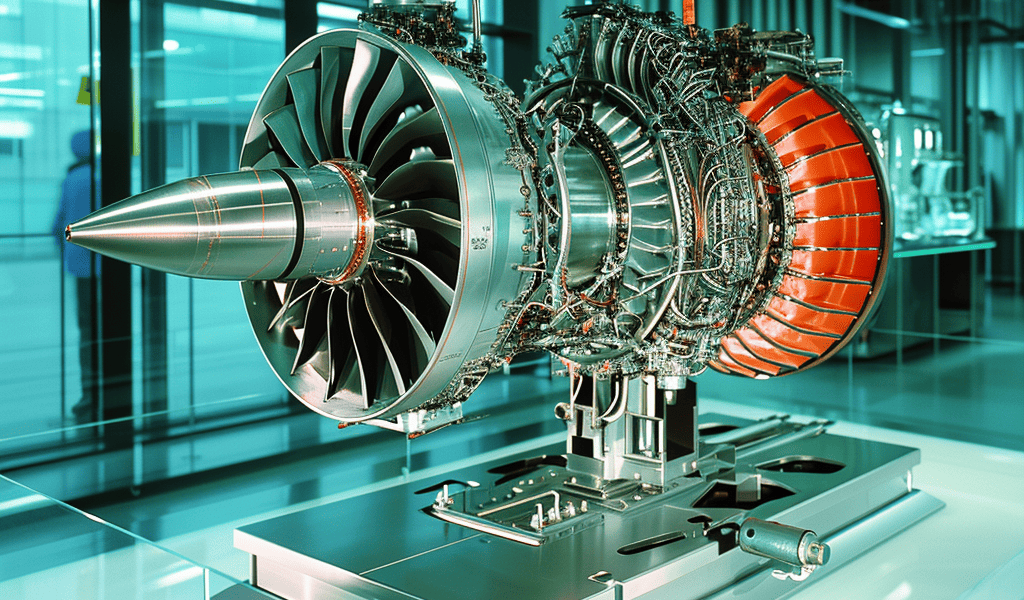

GE Aerospace reported higher orders, revenue, and operating profit in the quarter, attributing the success to commercial momentum and strength in services, which account for approximately 70% of the revenue. The company also announced a significant order for 202 GE9X engines and spares by Emirates to power its upcoming fleet.