BREAKING: Futures Edge Higher As Netflix Leads Earnings Winners

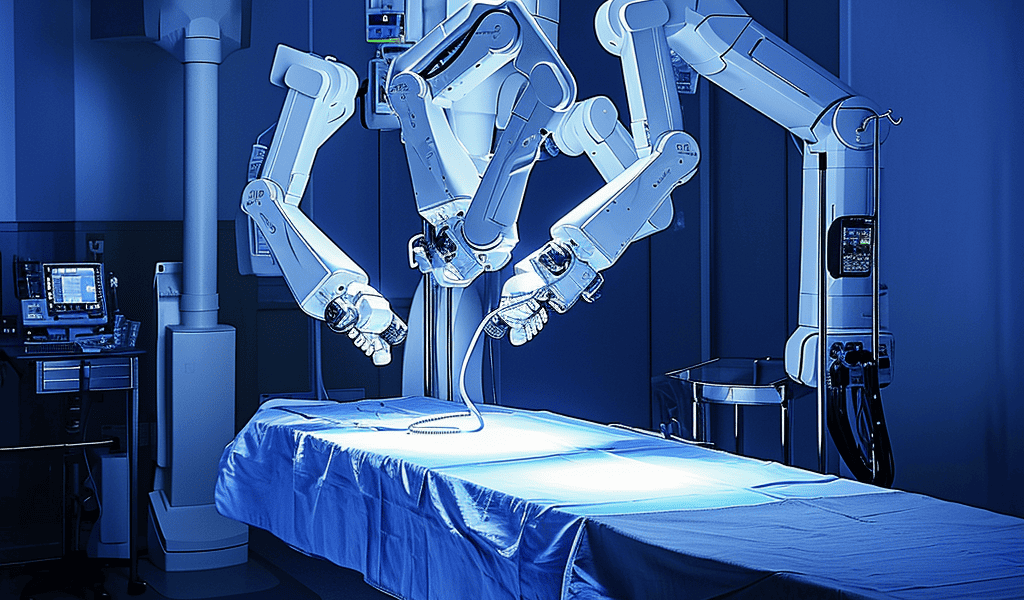

Intuitive Surgical Surges To A Record High With Rivals On The Horizon ‘Unlikely To Derail’ It Licensing

Intuitive Surgical (ISRG) will continue to dominate the growing robotic surgery market, an analyst said Thursday in a report that helped push ISRG stock to a record high.

Based on a survey of roughly 100 surgeons in the U.S., the number of Intuitive Surgical’s da Vinci robotic surgery systems installed in hospitals is expected to grow by double digits in the long term, according to UBS analyst Danielle Antalffy. This will come amid increasing competition that’s ‘unlikely to derail da Vinci,’ she added.

‘We remain bullish on the broader robotics market opportunity, the meaningfully long growth runway and the potential for more than one player to succeed (albeit with Intuitive Surgical the clear market share leader),’ Antalffy said in a report.

On today’s stock market, ISRG stock jumped 3.6% to 371.93. Earlier, shares hit a record high at 374.18.

Intuitive Surgical is the player in the biggest robotic surgery market. Recently, the company preannounced $1.93 billion in fourth-quarter sales. Those sales represent 17% growth and beat expectations for $1.89 billion.

Sales included $480 million in systems revenue following 12% growth in the number of da Vinci systems installed at hospitals. Intuitive Surgical installed 415 da Vinci systems during the December quarter.

Surgeons expect double-digit growth in the number of da Vinci robotic systems installed even after competitors launch their own systems, according to the UBS survey.

‘Most importantly, a double-digit installed base is a strong leading indicator for what could ultimately prove to be a double-digit robotic procedure volume growth longer term,’ Antalffy said.

Procedure growth is a key indicator for Intuitive Surgical. The more procedures performed, the higher sales climb for one-time tools and instruments. Bullishly for ISRG stock, fourth-quarter sales of instruments and accessories surged 22% to $1.14 billion.

Intuitive Surgical expects procedure volume to grow 13% to 16% this year. Antalffy says that’s likely a conservative view.

‘But the question for us is how conservative,’ she said.

Antalffy kept her neutral rating on ISRG stock.

Today, ISRG stock has an IBD Digital Relative Strength Rating of 89. This puts shares in the top 11% of all stocks when it comes to 12-month performance.

Shares recently broke out of a cup-with-handle base, topping a buy point at 318.26, according to MarketSmith.com. Intuitive Surgical stock is now closing in on a profit-taking zone, 20%-25% above the entry.

On Thursday, ISRG stock was the top-performing stock in its industry group, excluding penny and dollar stocks.

Follow Allison Gatlin on X