Fisker, the electric vehicle manufacturer, has reportedly hired restructuring advisers to assist with a potential bankruptcy filing, according to the Wall Street Journal. The company has been facing challenges, including the possibility of delisting its stock due to low share prices and expressing doubts about its ability to continue operating in its recent quarterly report. Despite a 300% increase in deliveries in Q4, Fisker has been seeking outside investment and considering a partnership with Nissan for electric trucks.

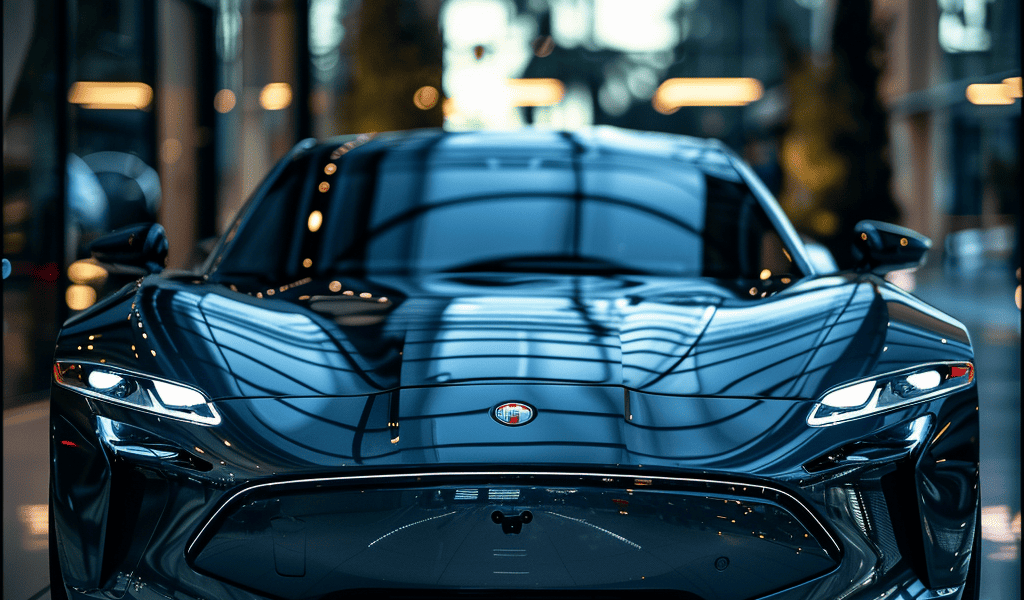

In addition to the potential partnership with Nissan, Fisker has unveiled plans for future vehicle designs, including a pickup truck named ‘Alaska,’ a compact car called ‘Pear,’ and the Ronin sports car. While the company claims to make money from the sale of its Ocean SUV, it has been struggling with significant costs associated with its direct-sales model and the need to scale the business.

Recently, Fisker announced a shift from its direct-sales model and plans to collaborate with dealer partners to sell its inventory of cars, estimated to be worth around $530 million as of March 1. However, the company faced another setback with the report that it has hired financial adviser FTI Consulting to assist with a potential bankruptcy filing, leading to a 45% decline in after-hours trading of Fisker shares.

Despite the report, it is important to consider the source and accuracy of the information. While the Wall Street Journal has a history of credible business reporting, it is owned by a climate denier, Rupert Murdoch, and has been associated with spreading climate disinformation. Regardless, the challenges faced by Fisker are evident, making it plausible for the company to seek consulting.