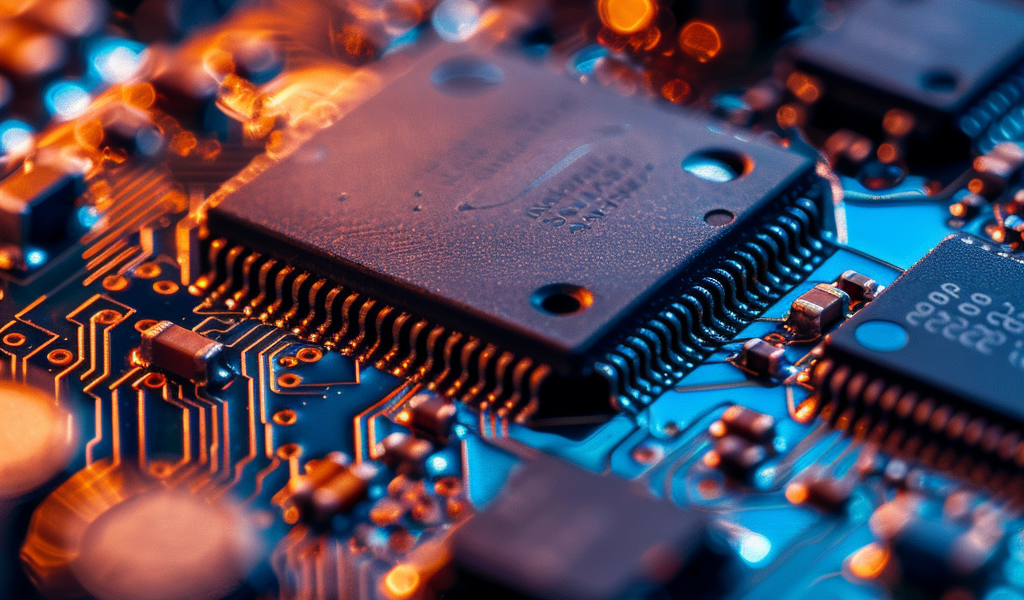

Are you looking for cheap semiconductor stocks to invest in? Look no further, as there are some hidden gems in the market that could offer great value for investors. In a world where AI is revolutionizing industries, finding the right semiconductor companies to back is crucial for long-term success.

One such company worth considering is Qualcomm (QCOM). With new chips in the pipeline and a promising partnership with Ampere Computing, Qualcomm is positioning itself for growth in the semiconductor space. Despite the market’s focus on GPU makers, Qualcomm’s potential should not be overlooked.

Another contender in the semiconductor industry is Applied Materials (AMAT). Despite a slight dip in share price after a strong quarter, this could present an opportunity for investors looking to buy low. The company’s performance indicates resilience and potential for future growth.

Taiwan Semiconductor (TSM) is also a player to watch. With a potential surge in sales expected, especially if AI phone sales pick up in the near future, Taiwan Semiconductor could be a lucrative investment option.

As the AI revolution continues to unfold, semiconductor stocks are becoming increasingly popular. However, it’s essential for investors to assess valuations and not overpay for stocks that may be overhyped. While major tech companies are heavily investing in AI, there are still opportunities in the semiconductor market for savvy investors.

Investors should be cautious not to chase after stocks at inflated prices, especially in a sector that may experience short-term volatility. By focusing on value and seeking undervalued stocks, investors can mitigate risks and potentially capitalize on future gains in the semiconductor sector.

Qualcomm, with its recent performance and strategic partnerships, remains an attractive option for investors seeking exposure to the semiconductor market. Applied Materials and Taiwan Semiconductor also present compelling cases for investors looking for value stocks in the tech sector.

As the semiconductor industry evolves, there will be winners and losers. By conducting thorough research and identifying undervalued opportunities, investors can navigate the market effectively and make informed investment decisions.