Super Micro Computer Stock Surges on Analyst Coverage and AI-Related Demand

Super Micro Computer stock soared 12.35% following favorable analyst coverage and strong AI-related demand, closing at $989.27. With a 210% increase in 2024 and an 872% rise over the last year, the company’s impressive results reflect its robust performance despite increased risk.

Study Reveals High Prevalence of Little-Known Pesticide Chlormequat in Human Bodies

A recent study by the Environmental Working Group found high levels of the little-known pesticide chlormequat in the urine of 77 out of 96 individuals, raising concerns about its impact on human health. The study highlights the potential risks of chlormequat, which has been linked to reproductive and developmental issues in animal studies. With increased levels found in urine samples and regulatory changes allowing its use on imported oats and other foods, the need for rigorous monitoring and regulation of pesticides to safeguard public health is emphasized.

Delta flight forced to turn back after maggots fall from overhead cabin

A Delta flight from Amsterdam to Detroit was forced to turn back after maggots fell from the overhead cabin onto unsuspecting passengers. The incident occurred when a passenger boarded the flight with a suitcase containing rotting fish, which broke open during the flight, causing the maggots to fall onto the passengers in the economy class. Passengers affected by the incident were compensated with 8,000 air miles, hotel room compensation, and a $30 meal ticket if they were delayed overnight.

Wells Fargo Regains Regulatory Approval

Wells Fargo’s primary regulator lifts penalty related to 2016 fake accounts scandal, causing shares to surge. CEO Charlie Scharf calls it a ‘milestone’ for the bank, as the fallout from the scandal tarnished its reputation and led to the departure of two CEOs.

HubSpot Surpasses Q4 Earnings Expectations and Provides Strong Guidance

HubSpot (NYSE: HUBS) has released its Q4 earnings report, surpassing analysts’ expectations and providing a strong guidance for the upcoming year. The company reported Q4 EPS of $1.83, exceeding the analyst estimate of $1.54. Additionally, the revenue for the quarter stood at $581.9 million, surpassing the consensus estimate of $558.46 million. HubSpot’s positive performance and optimistic guidance have garnered attention from investors and analysts, indicating a promising outlook for the company. The news has led to a surge in the company’s stock, with shares experiencing a notable increase in value. These developments underscore HubSpot’s strong position in the market and its ability to deliver robust financial results.

Tesla board remains silent after court ruling on Elon Musk’s pay package

Delaware court rules that Tesla must rescind Elon Musk’s $56 billion pay package, but the company’s board remains silent. Musk lashes out at the court and plans to hold a shareholder vote to move Tesla’s site of incorporation to Texas. Shareholders await answers as Tesla’s board stays silent, avoiding public comments.

Norwegian Cruise Lines Removes Antarctica from Itineraries, Leaving Passengers Furious

Norwegian Cruise Lines has left passengers furious after removing Antarctica from the upcoming itineraries of its ship, the Norwegian Star, at the last minute. The decision has sparked uproar among affected passengers, with many expressing frustration and anger over the unexpected change.

Occidental Petroleum Corp Reports Strong Fourth Quarter for 2023

Occidental Petroleum Corp (OXY) has reported a strong fourth quarter for 2023, with key financial highlights reflecting operational performance and strategic growth. The company achieved a net income of $1.0 billion, or $1.08 per diluted share, and an adjusted net income of $710 million, or $0.74 per diluted share. Production exceeded guidance with 1,234 Mboed, and OxyChem Performance saw pre-tax income of $250 million, surpassing expectations. The quarterly dividend was raised by 22% to $0.22 per share, and strategic acquisitions, including the CrownRock acquisition and the Carbon Engineering acquisition, have enhanced the company’s onshore portfolio and supported low-carbon initiatives. Occidental’s proved reserves grew to 4.0 billion BOE with a reserves replacement of 137%. Operational excellence was a key driver of Occidental’s financial success, with operating cash flow reaching $3.2 billion and cash flow from operations before working capital at $2.5 billion. Despite challenges such as lower domestic crude oil prices and higher lease operating expenses, the company’s worldwide production exceeded expectations, demonstrating operational resilience and a strategic asset base. The oil and gas segment reported a pre-tax income of $1.6 billion for the quarter. Occidental’s strategic growth was underscored by the acquisition of CrownRock, which enhances its U.S. onshore portfolio with premier Permian Basin assets, and the acquisition of Carbon Engineering, supporting low-carbon initiatives. These moves are significant for the company’s long-term growth and shareholder value.

Meta Platforms Inc. Adds Two New Members to Board of Directors

Meta Platforms Inc. appoints Hock E. Tan and John Arnold to its board of directors, following the departure of Sheryl Sandberg. CEO Mark Zuckerberg expresses excitement about the expertise Tan and Arnold bring, particularly in silicon and energy infrastructure, crucial for Meta’s long-term vision, including the development of artificial general intelligence. With the addition of Tan and Arnold, Meta’s board now comprises 11 members, including Sandberg, who is set to step down at the company’s annual shareholder meeting in May. Prior to joining Meta’s board, Tan had collaborated with the company in his capacity at Broadcom, while Arnold has been involved in criminal justice reform initiatives, aligning with Zuckerberg’s investment company, CZI.

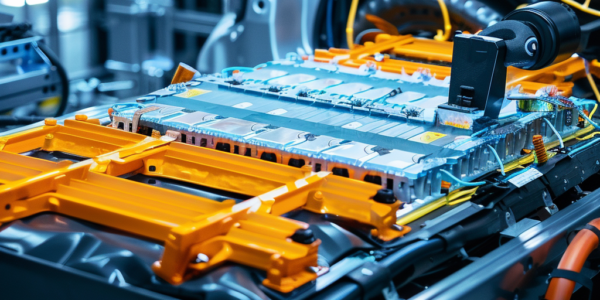

Albemarle Posts Better-Than-Expected Quarterly Profit Despite Weak Lithium Prices

Albemarle, the world’s largest lithium producer, has reported a better-than-expected adjusted quarterly profit despite weak lithium prices. The company’s aggressive cost-cutting measures have helped offset the plunging prices for the metal used in electric vehicle batteries. Despite the challenges posed by weak lithium prices, Albemarle has indicated its commitment to continue funding its Arkansas direct lithium extraction project.