In the fast-paced world of finance, after-hours trading can reveal significant insights into market movements. Recently, several companies made notable headlines as their stock prices fluctuated in the after-hours session. Among these companies, United Airlines and J.B. Hunt stood out, reflecting broader trends in the transportation and logistics sectors.

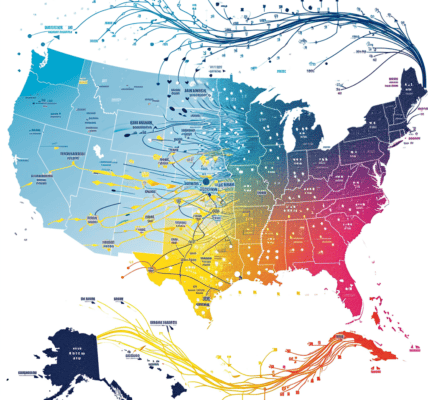

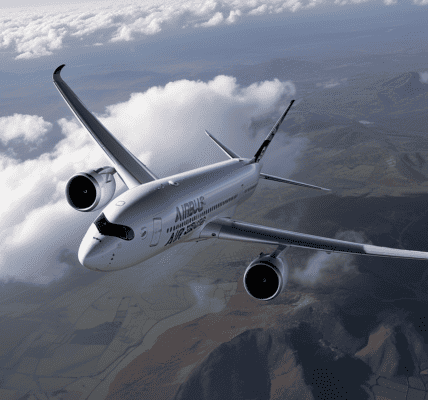

United Airlines, a major player in the aviation industry, experienced a notable shift in its stock price following the release of its quarterly earnings report. Investors reacted positively to the airline’s performance, which showcased a resurgence in travel demand. The report highlighted increased passenger numbers and a strategic focus on expanding routes, which are essential for recovery post-pandemic. This positive sentiment among investors reflects a growing confidence in the airline’s ability to navigate ongoing challenges in the travel sector.

On the other hand, J.B. Hunt, a leader in freight transportation, also saw significant movements in its stock after reporting its earnings. The company’s results indicated a robust demand for freight services, driven by e-commerce growth and supply chain recovery. J.B. Hunt’s investments in technology and infrastructure have positioned it well to capitalize on these trends, leading to an optimistic outlook among analysts. Investors are particularly keen on the company’s ability to adapt to changing market dynamics, further strengthening its market position.

As the financial landscape continues to evolve, after-hours trading serves as a critical indicator of investor sentiment and market trends. Companies like United Airlines and J.B. Hunt are at the forefront of this evolution, demonstrating resilience and adaptability in a competitive environment. Tracking these movements provides valuable insights for investors looking to navigate the complexities of the market.

Moreover, the performance of these stocks can have broader implications for related sectors. For instance, a rebound in airline stocks often correlates with increased activity in travel and hospitality, while strong results from freight companies can signal growth in manufacturing and retail. Understanding these connections is vital for investors aiming to make informed decisions.

In addition to the earnings reports, macroeconomic factors also play a significant role in shaping market reactions. Investors are closely monitoring indicators such as inflation rates, interest rates, and employment data, all of which can impact consumer spending and, consequently, corporate earnings. The interplay between these economic indicators and individual company performance is a focal point for analysts and investors alike.

As we move forward, the market will undoubtedly continue to react to new information and developments. The ability to interpret these movements in real-time is essential for investors seeking to capitalize on opportunities. Keeping an eye on after-hours trading can provide a strategic advantage, offering insights into potential market shifts before the next trading day begins.

In conclusion, the after-hours trading sessions of companies like United Airlines and J.B. Hunt illustrate the dynamic nature of the stock market. By staying informed and engaged, investors can better navigate the complexities of the financial landscape and make strategic decisions that align with their investment goals.