Lattice Semiconductor (NASDAQ:LSCC) has recently reported a disappointing performance in Q4 FY2023, causing a drop in its stock value. The semiconductor designer fell short of analysts’ expectations with a 3% year-on-year revenue decline to $170.6 million. Furthermore, the company’s revenue guidance for the next quarter also failed to meet estimates, coming in 19.7% below analysts’ expectations at $140 million.

In addition to the revenue miss, Lattice Semiconductor experienced a decrease in non-GAAP profit, dropping from $0.49 per share in the same quarter last year to $0.45 per share in Q4 FY2023. The company’s free cash flow also saw a decline of 12.2% from the previous quarter, amounting to $68.24 million.

Despite these challenges, Jim Anderson, president and CEO of Lattice Semiconductor, highlighted the company’s achievement of double-digit annual revenue growth in 2023, along with record gross margin and continued profit expansion. Anderson emphasized the company’s strong position for the long-term, supported by a rapidly expanding product portfolio and robust customer momentum.

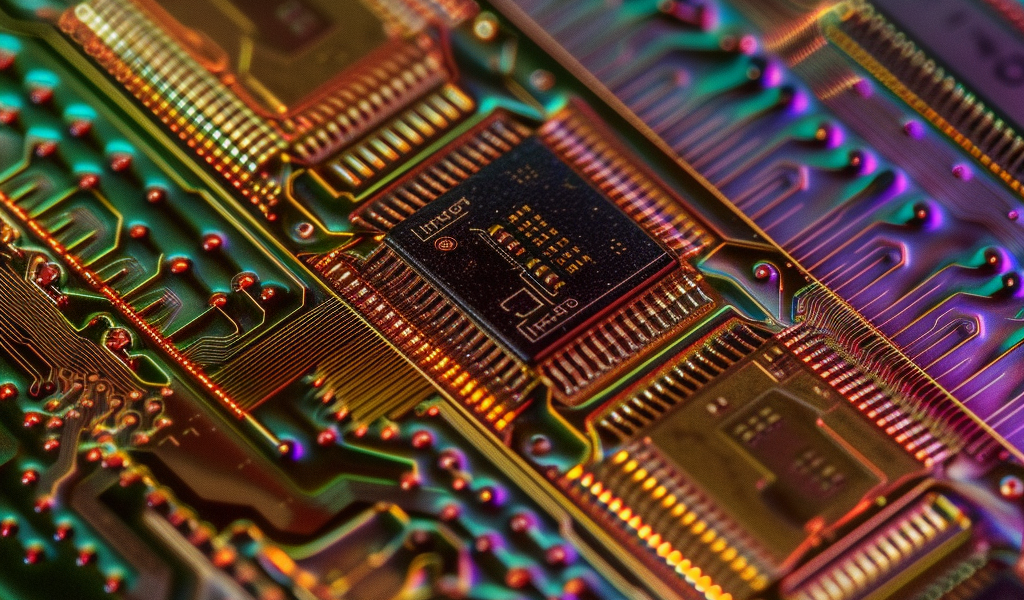

Lattice Semiconductor, known for its specialization in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning, operates in a market driven by significant demand for processors and graphics chips. The current demand drivers for these components include 5G and Internet of Things trends, autonomous driving, and high-performance computing in the data center space, particularly related to AI and machine learning.

While Lattice Semiconductor has demonstrated strong revenue growth over the past three years, averaging 22.2% annually, the company, like other semiconductor manufacturers, faces cyclicality influenced by supply and demand imbalances, as well as exposure to PC and smartphone product cycles.