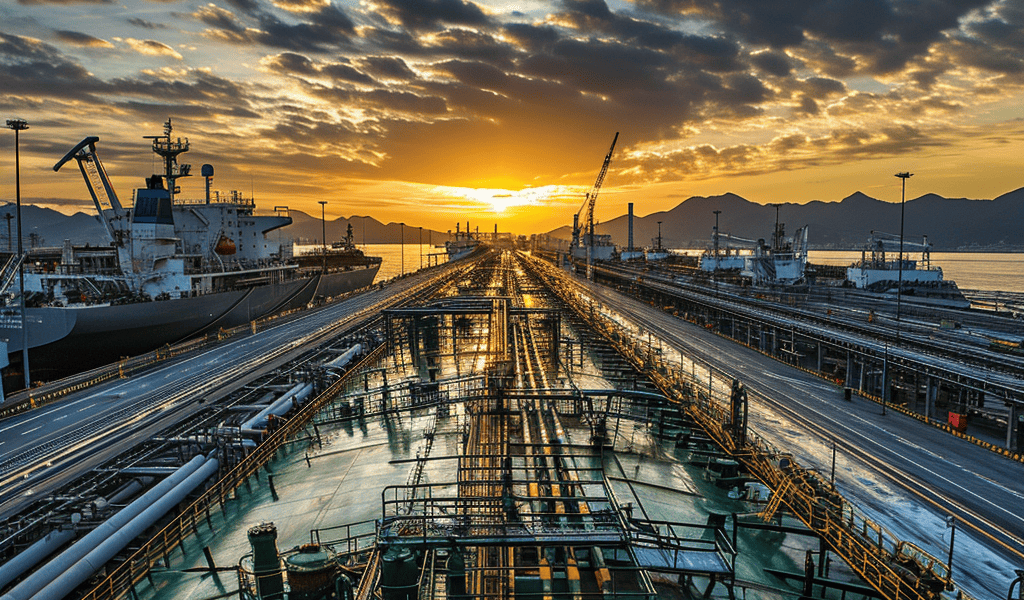

Surge in Freight Rates Impacting Global Oil Market, Favoring Middle Eastern Grades Over US Cargoes

A recent surge in freight rates has led to a significant impact on the global oil market, particularly in Asia. The increase in shipping costs has prompted crude oil buyers in Asia to shift their focus to Middle Eastern oil, as it has become more cost-effective compared to long-haul crude such as US cargoes. This shift in purchasing behavior has resulted in higher cargo premiums and has contributed to supporting the market.

The fluctuation in oil prices since the beginning of the year has been influenced by various factors, including the outlook for demand and tensions in the Middle East. Saudi Arabia’s decision to reduce official oil prices to Asia has highlighted underlying softness in the market. However, the recent surge in freight costs is now reverberating through the market, favoring Middle Eastern grades over US cargoes.

Analysts at Energy Aspects Ltd. noted that the increase in freight rates will likely lead to a stronger preference for Middle Eastern grades, with Japanese and Indian refiners opting for Murban over WTI, a grade from Abu Dhabi and the US benchmark, West Texas Intermediate. This shift has resulted in a premium increase for Murban futures, reaching the highest level since late November.

The surge in freight rates can be attributed to a flurry of supertanker booking activity for long-haul voyages, particularly by Sinokor Merchant Marine Co., which has tightened vessel availability. Rates for the US Gulf Coast-to-China route surged to $9.86 million on Tuesday, up almost $2 million from a week earlier, according to Baltic Exchange data. Additionally, attacks on vessels in the Red Sea by Houthi rebels in Yemen have contributed to the heightened shipping costs, highlighting sustained tensions in the area.

Analysts at Energy Aspects Ltd. anticipate that freight rates will remain elevated ahead of the long weekend in the US, citing tighter availability, strong sentiment across the board, and weather-related disruptions for ship-to-ship operations. The surge in freight rates has significant implications for the global oil market, particularly in Asia, and is expected to continue impacting purchasing behaviors and cargo premiums in the near future.