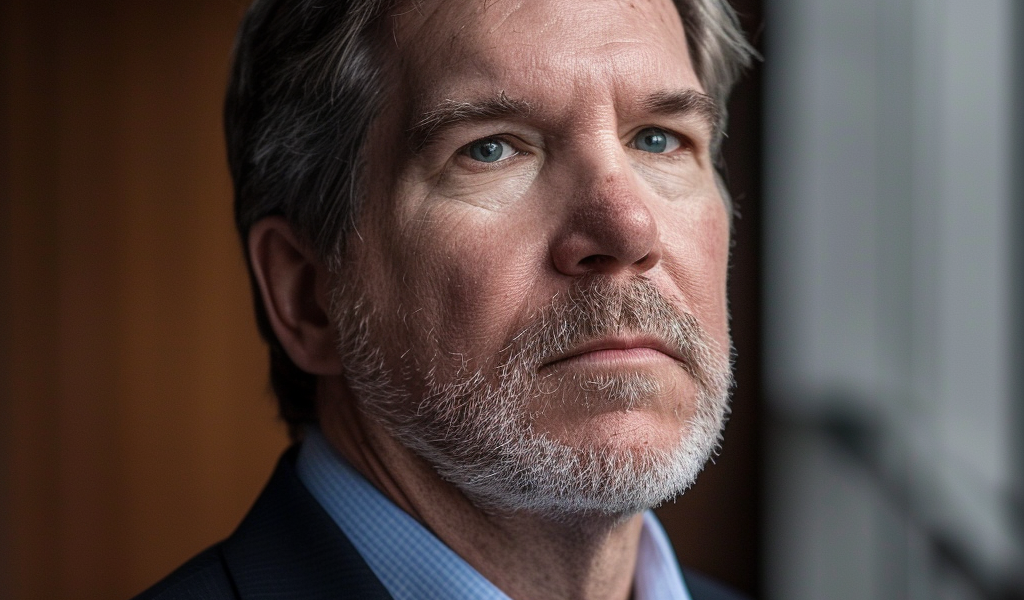

Michael Saylor, the Executive Chairman and 10% Owner of MicroStrategy Inc (MSTR), recently made a significant transaction by selling 5,000 shares of the company. This sale, reported in a SEC Filing, is part of a series of transactions by the insider over the past year, totaling 265,000 shares sold without any purchases of the company’s stock.

MicroStrategy Inc, a provider of enterprise analytics and mobility software, is best known for its flagship product, MicroStrategy 10, which offers a platform for businesses to analyze diverse data sources and derive actionable insights across various industries such as retail, finance, healthcare, and government.

With 114 insider sells and no insider buys over the past year, the insider transaction history for MicroStrategy Inc reflects a trend of insider selling. On the day of the recent sale, shares of MicroStrategy Inc were trading at $1,870.41, resulting in a market cap of $32.56 billion and a price-earnings ratio of 68.10, which surpasses the industry median of 27.09 and the company’s historical median price-earnings ratio.

According to the GF Value, MicroStrategy Inc has a price-to-GF-Value ratio of 7.53, indicating that the stock is Significantly Overvalued. This value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

The recent insider sale may offer investors insights into the company’s valuation and future prospects. However, investors are advised to consider a wide range of factors and conduct thorough research before making investment decisions. It’s important to note that the article, generated by GuruFocus, provides general insights and is not tailored financial advice. The commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. The objective is to deliver long-term, fundamental data-driven analysis, but it may not incorporate the most recent, price-sensitive company announcements or quarterly earnings updates.